White label trading platforms dominate the binary options market. 90 percent of all traders trade with them, even though most of them may not know it. This article explains what white label brokers do, their prices and costs, and why you need to understand them.

This article will answer these questions:

- What Is A White Label Broker?

- What Do White Label Brokers Provide?

- The Problems With White Label Brokers

- Which White Label Brokers Are There?

- Should I Use A White Label Broker?

What Is A White Label Broker?

White label brokers have an interesting business model. They provide everything a broker needs from banking to trading software, but they allow other people to put their branding on their products and sell them to the end customer.

When you trade with a white label broker, you may not know it.

All you see is a normal trading interface, a typical broker branding, and a perfectly normal website. However, this is everything the broker does by themselves.

The remainder of their trading platform – everything you don’t see that makes the technical side of the business work – is run by a white label broker.

Rebrand

White label products are a century-old fixture of the business world.

Today, many Chinese firms sell white label products that are branded by their Western partners because they sell more items this way than by selling them under their own brand.

Among others, this applies to mountain bikes, tooth paste, and electronics.

Even the investment world has seen many white label solutions. For example, when CFDs became popular, many established brokers and banks wanted in on the growing market without programming their own solutions.

White label CFD brokers allowed them to offer the service to customers without having to develop their own products – a win-win situation.

Binaries A Logical Step

Adapting the same idea to binary options seemed like a logical step. Creating a trading platform is a difficult and expensive process and there are many requirements that the platform has to deliver.

Prices have to be on time and exact, the execution of trades has to be spot on, and customer management and customer support require huge systems.

A single mistake in one of these areas could land someone in jail.

In this environment, it makes sense that new brokers decide to purchase their systems from a trustworthy source with a lot of experience.

Previously, white label brokers made up almost the entire binary options market. Of the many, many binary options brokers, only a handful used their own trading systems. In more recent times, brands focus on their own offerings.

What Do White Label Brokers Provide?

White label brokers provide all the systems that you need to create a binary options broker. In detail, those systems are:

Trading Platform

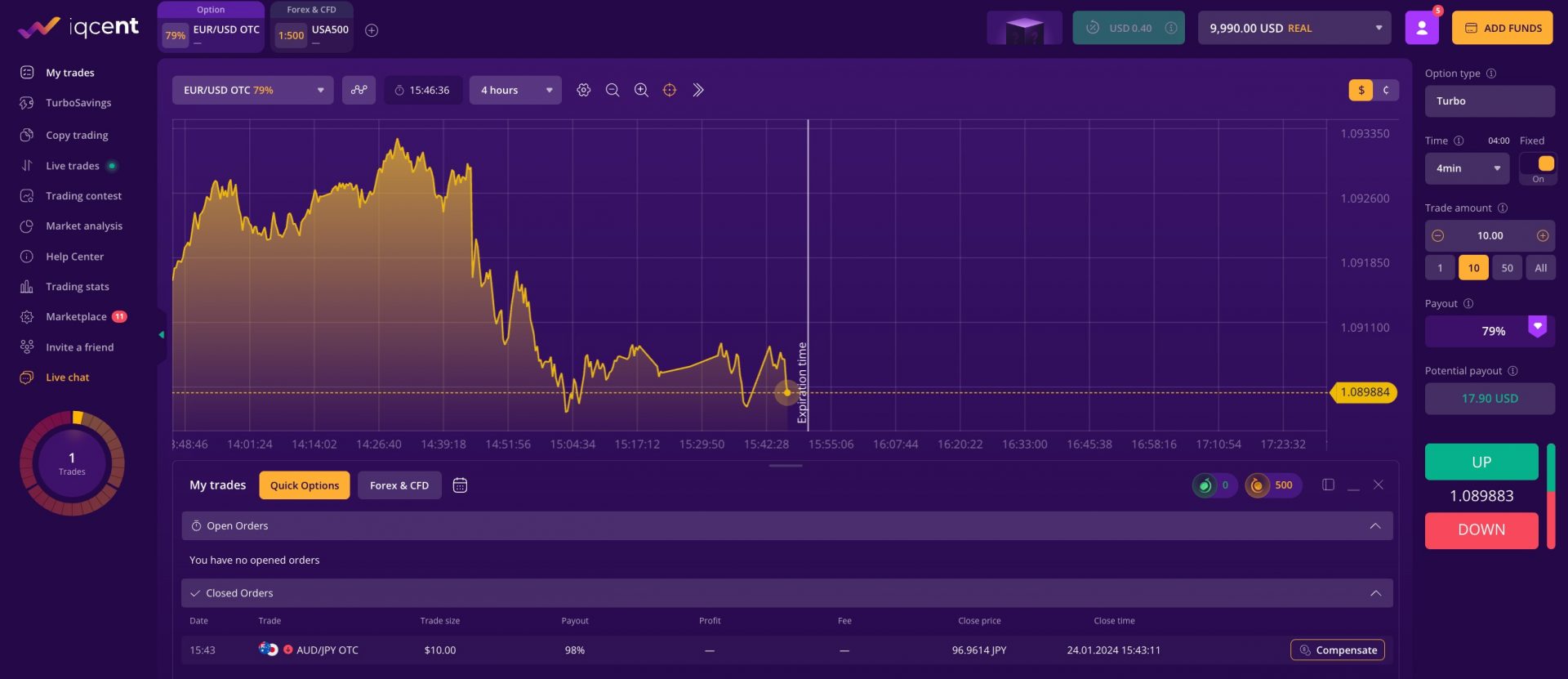

The trading platform is the part of the broker that traders use to invest. Good trading platforms are difficult to create because they have to provide accurate analysis tools, precise prices, and simple investment opportunities.

Each of these complex systems requires huge amounts of data and takes a lot of time to program, which is why many new brokers are reluctant to program their own platforms.

White label brokers provide platforms that brokers can use. They also allow them to adapt them to their needs. Every broker can apply their own styling, choose the colours, and adapt the layout of the platform. They also select which trading tools to offer, which assets, and which analysis tools.

White label brokers offer the toolbox that new brokers can use, but the brokers decide how to use them.

Content Management System (CMS)

Brokers need a website on which they display the newest information, their businesses, and a signup form. These websites are created with content management systems.

Content management systems are complex programs that allow you to easily manage your website.

Once you have such a system, managing your website is easy. But programming it is complicated, time-consuming, and expensive.

This is why most brokers prefer to buy pre-made content managements systems. White label brokers offer these systems, including special features for binary options such as economic calendars.

When you look at the websites of binary options brokers with this knowledge, you will find that many of them are similar in structure and content. These brokers all use the same white label broker.

Customer Relations Management (CRM)

Customer relations management is a necessary but expensive part of any business. Answering customer requests requires a lot of man power, and for small businesses, it is disproportionally more expensive than for larger ones.

For new brokers, it makes sense to outsource the task. Otherwise, they would have to employ several customer service people with their first customer – which would ruin them.

White label brokers allow many brokers to share the same customer relations management. This system reduces overall cost and allows even new brokers to offer 24/7 customer support via email, phone, and live chat.

Payment Solution Integration

When you accept online payments, there is a lot to consider.

New brokers need a secure, unhackable system that is easy to use and works in combination with as many payment options as possible (Skrill, Paypal, Wire transfer etc). Such systems are complex and expensive to create.

Therefore, it makes great sense for new brokers to buy pre-made systems.

White label brokers offer payment solution integration. T

his means they offer pre-made systems that can handle customer payments and withdrawals, automatically book deposits to the right accounts, and make sure that the money is safe.

Their customers get a better, safer system that is still cheaper than if they did everything on their own – a win/win for both sides.

Risk Management Solution.

Starting a new binary options broker can be risky. In the worst case, a new customer deposits a lot of money, invests everything in one trade, and wins. This could ruin the broker.

When brokers become bigger and have thousands of customers, they will experience less volatility because the actions of many traders will even out more. But to survive the start, they need a good risk management solution.

Platform providers offer brokers pre-made risk management solutions that allow new firms to easily start their new businesses without risking an early bankruptcy.

For brokers, these systems are the insurance that guarantees their survival, which is why many brokers use them. It would almost be foolish not to do it.

These advantages show why white label brokers are so popular. Especially trading sites that already offer other trading styles such as stocks or CFDs can use white label brokers to easily integrate binary options into their system.

These brokers already have the branding they need and can attract an entirely new group of customers with a few simple clicks – why would they reject this opportunity?

The Problems With White Label Brokers

So far, the point of this post was that white label systems are a great idea – in theory. That is why they have been around for decades in all types of industries. The point we will make now is that things are a bit more complicated with binary options.

While there is nothing wrong with white label brokers in general, a few black sheep have found their way into the binary options world.

Their only goal is to scam traders out of their money, which they do in increasingly inventive and sometimes downright criminal ways.

Where a white label broker is exposed as dishonest, it is a simple process to close down, and start again under a new name with the same platform provider. The larger providers in the business did little to stop this happening. Some would argue they were complicit in it.

When you sign up with a white label broker you increase trading risks – the broker is less likely to be regulated, be properly financed or be trade honestly. Due to the speed with which these brands can be setup, risk of fraud increases.

Our scams page highlights some of these issues, but the risk is much greater when using a white label.

Should I Use A White Label Broker?

We recommend treading very carefully with these types of brokers. While there is nothing wrong with the basic idea of white label services, there seems to be a difference between how these brokers market their products to people who want to start their own brokerage and how those people market them to the end customer.

End customers are often lured in with promises of great investment opportunities and financial gains. But the white label brokers themselves talk more about the gaming aspect and how they have structured their products to lose traders money.

The simple truth is that there are plenty of other brokers out there that use their own trading platforms. Those brokers offer better opportunities for long-term success than white label brokers. In our top list, you find the best of them. They are all government regulated and provide a secure trading environment. We recommend choosing these brokers over white label brokers.