EmpireOption Forex Trading

EmpireOption offer Binary Option, CFD and Forex trading through its online platform, with no software download necessary. The forex product they offer is a mix between a binary option and a spot position. It has the features of a binary option – in that your maximum loss is established prior to the trade being placed, just like the investment level of a binary option controls risk. It also has an expiry date where your strike price will be equal to the entry price of the trade. Like a binary option it has a maximum fixed payout. Now it is also similar to a spot in that you can choose your maximum level of loss (stop loss) and, more importantly, you can also choose your maximum level of payout. This appears on the screen as a large black number expressed as a percentage of your investment.

Forex trading Hybrid version

The screenshot below shows the middle of the member’s page. To the left of the grey tool bar you can choose your currency pair e.g GBP/USD, next to that there is a ‘leverage’ box which tells you the contract size.

The contract size (1:25, 1:50 and so on) determines how far away your stop-loss and target profit are going to be from the entry price. You can see the levels of stop-loss and profit in the green box for a long position and in the blue box for a short position. Basically the higher the leverage (larger contract size) the closer the stop-loss and target profit will be.

Clicking on BUY or SELL puts you into a Long or Short position in the selected currency pair. A window opens up with the first click, with a summary of stop-loss, target profit (expressed in Pounds) and exchange rates for each. A handy feature just to give your trade one last check before you put it on.

Once you are in the trade the payout structure works the same as being Long or Short the currency pair in a ‘standard’ Forex trade. In the blue and green boxes you will see the ‘pip’ value. Very useful – as it tells you clearly how much you will gain or lose per pip – in the above example £1.64. This corresponds to the contract size you chose in the toolbar at the top of the screenshot. 1:250 corresponds to £25,000 with an investment of £100 (100:25,000 = 1:250). If GBPUSD goes up 10 pips you will gain or lose £16.30. In the example in the screenshot your position will be stopped if your loss reaches £100 or you gain £150. If your stop loss is hit you lose your initial investment, in the example £100. If your target is reached you gain £250 – that is your initial investment (£100) plus the profit from the trade (150).

Of course the higher the investment the more your contract size will increase, for example increasing the stop-loss/investment to £200 will show a contract size of £50,000 which means your pip value will also double to £3.27. What won’t change is the level of your stop-loss and target profit. To change these levels you will need to change the leverage or contract size. The higher the leverage the closer the stop-loss and target profit will be, as each pip is worth more.

Where is the stop-loss and target profit displayed?

That is a question every trader should be asking before putting on a trade. In fact most Forex broker’s platforms show the contract size and let you figure out pip value for yourself. With that information you then calculate how far away your stop-loss and target profit will be according to your risk return profile for the trade. At EmpireOption they take it from the opposite angle. They start with how much your stop-loss and target profit are in money terms and then calculate for you the corresponding exchange rates. This makes it easier to look at a trade from a risk return profile. With those levels of stop-loss and target profit in mind a quick look in the blue or green box will specify the exchange rates for both. If a trader felt they are too close or too far away, all they need do is amend the contract size.

Functionality

This site is very user friendly. As a binary options broker that also offers Forex trading, simplicity remains key. All the information that is vital to deal in the markets is at hand on the member’s page. The layout is bright and simple with easy to see boxes and buttons and is very intuitive. The only issue, is that it takes an extra click to enter a trade. The first click opens a summary window with all the relevant information about the trade. That is a useful ‘final check’ before a trade is placed. However, once clicked to confirm, there is then another field that appears within the window, requesting approval. This last window may be for compliance reasons, but if it could be amalgamated with the confirmation window, the trading process would be that much quicker and simpler. The process will ‘approve’ the deal automatically after just a few seconds, if left untouched.

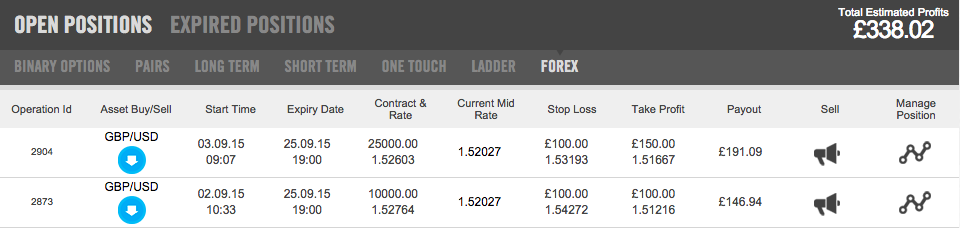

The screen shots below show the open position tab and expired position tab. Both have all the information traders need and are easy to read. The open position tab is where trades can be closed out (‘Sell’) before expiry. Markets can change quickly, and this product, just like spot Forex, allows you to cancel, or ‘cash in’ the trade at any moment. Upon which you will receive the corresponding pip price at that moment.

On the open position’s tab traders can also change the stop-loss and target profit levels. As often happens the market may show a strong movement in the direction of a particular trade and traders may want to increase the maximum payout. This can be achieved by clicking on the “Manage Position” icon to the right.

The expired positions tab shows how previous (closed) trades have performed. The icon on the right under “Expiry Chart” shows where the market was at the time of expiry on a chart. The remaining columns headings are fairly clear, and illustrate all the details of the trade. Two things missing here are; A running balance, it’s actually all the way at the top of this page and therefore out of sigh. Also, for those traders that like keeping their own statistics, the possibility to export trades to excel is another feature which is not available.

Overall Empire Option provide an innovative way to trade Forex. Taking the binary options ‘starting point’, of clarifying risk and reward at the outset, and then modelling the investment from there (in terms of stop-losses and target prices) is a unique model that should appeal to traders looking to invest in currency pairs for the first time.