US retail outlook

Retail in the US for 2015 has been fickle and difficult to anticipate. Consumers are spending all over the map, from e-commerce to big box stores, with everything from the price of oil to wage growth playing a part in spending habits. Anticipating consumer spending is a daunting task. Because there are so many economic indicators that play a role in the retail marketplace there are several trends that need to be taken in to account when looking at where retail stocks might go in the coming summer months and beyond.

Retail in the US for 2015 has been fickle and difficult to anticipate. Consumers are spending all over the map, from e-commerce to big box stores, with everything from the price of oil to wage growth playing a part in spending habits. Anticipating consumer spending is a daunting task. Because there are so many economic indicators that play a role in the retail marketplace there are several trends that need to be taken in to account when looking at where retail stocks might go in the coming summer months and beyond.

Wage growth and employment

Consumers cannot spend money in the retail marketplace if they don’t have jobs. This is why spending in Q2-Q3 is closely tied to that of wages, especially in the summer months when part-time workers, like students, are able to find seasonal employment that affords them extra spending money. Unfortunately, wage growth has been terrible so far this year for Americans, which may severely inhibit consumer spending in the coming quarter. Wage growth also allows families to take vacations, where much retail spending in the apparel and luxury items industries occurs. Without vacations luxury brands like Michael Kors (KORS) and Coach (COH) can be significantly hurt.

Back-to-school spending

Towards the end of the summer, back-to-school shopping also plays a large role in consumer retail spending. Retailers like Target (TGT), Walmart (WMT), and others rely on the influx of purchases for the upcoming school year during the late summer months. During the back-to-school shopping season, running from late July to early September, consumers spend extra on everything from electronics to clothing and accessories. However, this spending is dependent on school enrolment numbers, which for primary education are expected to continue to decrease over the coming decade. The bottom line is, less enrolled students’ means less back to school shopping.

Additionally, back-to-school shopping trends are changing as quickly as technology. This is especially true when it comes to the technology sector, where new technology shapes purchases for students. The change in spending habits between 2013 and 2014 back-to-school shopping seasons is evident and will continue to progress. In the early 2000’s laptops began to replace desktop computers, and now, tablets are continuing to erode market share away from laptops. Industry leaders Apple (AAPL) and Microsoft (MSFT) have successfully kept up with the market and should continue to do well in the back-to-school season. However, one area that will continue to decline is printer sales, where companies like Hewlett-Packard (HPQ) and Canon (ADR) have stopped seeing a boost in sales from the student demographic.

Consumer oil demand

Oil prices play a role in how much consumers spend in the summer months, which can greatly impact the performance of large retailers. Like most commodities, seasonal changes in weather affect the demand for oil. Q3 brings with it the summer months of warm weather and family vacations, driving up the demand for gasoline. Even though the market knows these seasonal changes come, it cannot fully factor in its effect until it sees how the exact weather plays out. When the warm weather extends longer than usual, from April through September, families tend to take more vacations and therefore spend more on gasoline, driving up the price of oil. With much of the country expected to see below average summer temperatures, it may be an indication of a slowdown in the demand of gasoline, leading to lower than expected demand for oil.

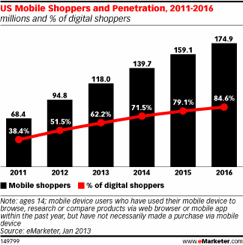

E-commerce on the rise

E-c ommerce retail spending has been on the rise since its inception. Amazon (AMZN) has taken market share away from large retailers around the world in every retail category. Even baby boomers, the largest population in the US, are becoming more versed in using e-commerce as an easier way to shop.

ommerce retail spending has been on the rise since its inception. Amazon (AMZN) has taken market share away from large retailers around the world in every retail category. Even baby boomers, the largest population in the US, are becoming more versed in using e-commerce as an easier way to shop.

If the summer weather is unseasonable it may lead to more consumers shopping online for their back-to-school needs. This will surely help large online retailers like Staples (SPLS) and Office Depot (ODP) who do a great deal of business in school supplies. Other apparel companies, such as Nordstrom (JWN), have also begun to beef up their online presence in hopes of keeping up with the growing e-commerce trend.

Currency concerns

If the previous two quarters were any indication, the currency market will have a large impact on the coming months in the retail sector. Currency prices led to the rise and fall of many large retailers in the industry. Companies like Gap (GPS) were hurt by a strong US dollar which caused foreign currency sales to be worth less once the money came back to America. On the flip-side, some retailers like Tiffany & Co. (TIF) were supported by a weakened euro as foreign shoppers were given more incentive to make luxury goods purchases while traveling. It seems that the currency market can have varying effects on individual companies throughout the retail sector depending on their business model.

US traders are welcome at CherryTrade, read our full review here.