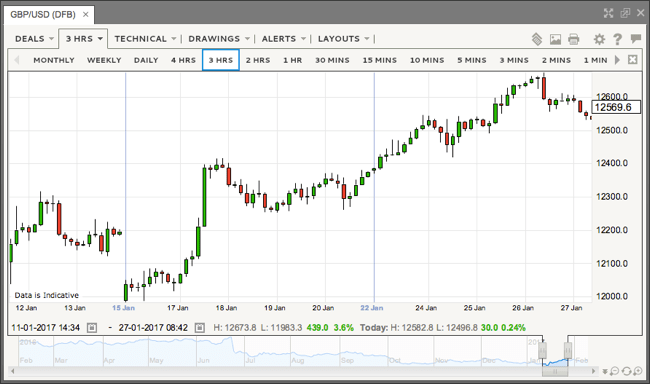

Pound enjoys biggest gains in January in six years

The pound recorded its best January in six years on Tuesday, due in no small part to the faltering dollar that’s struggling under the weight of uncertainty following President Trump’s inauguration.

Although the surge in sterling was not without its hurdles to overcome, it was the pound’s first positive start to a year since 2012.

Nevertheless, new Bank of England data published this week indicates that the rate of borrowing among UK consumers slowed in December 2016 for the first time in five months, an early indicator that household spending is slowly being curbed due to increasing inflation.

Consumer Spending Impact

Following the Bank’s consumer borrowing news, the pound fell to $1.2412, but rallied quickly to a high of $1.2593 as President Trump and his leading trade adviser spoke negatively about the devaluation of other nation’s currencies.

Despite its solid move against the dollar, sterling continued to lack support against the euro (0.2% down), as well as the Swiss franc and the Japanese yen.

“It [sterlings surge against the dollar] is very much a function of the political mess that is unfolding in Washington,” noted Ned Rumpeltin, TD Securities’ head of European currency strategy.

“Clearly the focus on idiosyncratic currency risks has been replaced by the systemic risk,” he added.

Warning Signs For GBP

Another warning signal for UK markets was that separate bank figures showed more foreign investors had sold British government bonds (gilts) than purchased them for the first time since July 2016.

With some signs of weakness within UK data, February promises to be a very interesting month with Prime Minister Theresa May attempting to obtain parliament approval for the right to trigger Article 50. She will then begin formal negotiations to leave the European Union (EU) after the Supreme Court ruled last month that May could not make the decision alone.

May’s Conservative government are likely to use their parliamentary majority to ensure the Brexit bill meets the needs of the 52% majority that voted for tighter immigration controls over membership of the EU’s single market.

As a consequence, global banks must prepare for a “hard” Brexit or face the prospect of breaching regulatory requirements that could disrupt business.