In the summer of 2017, gold trading offers a few exciting possibilities for binary options traders. Below, we explain why, and how traders can take advantage when trading the yellow metal this year;

What’s Happening To Gold?

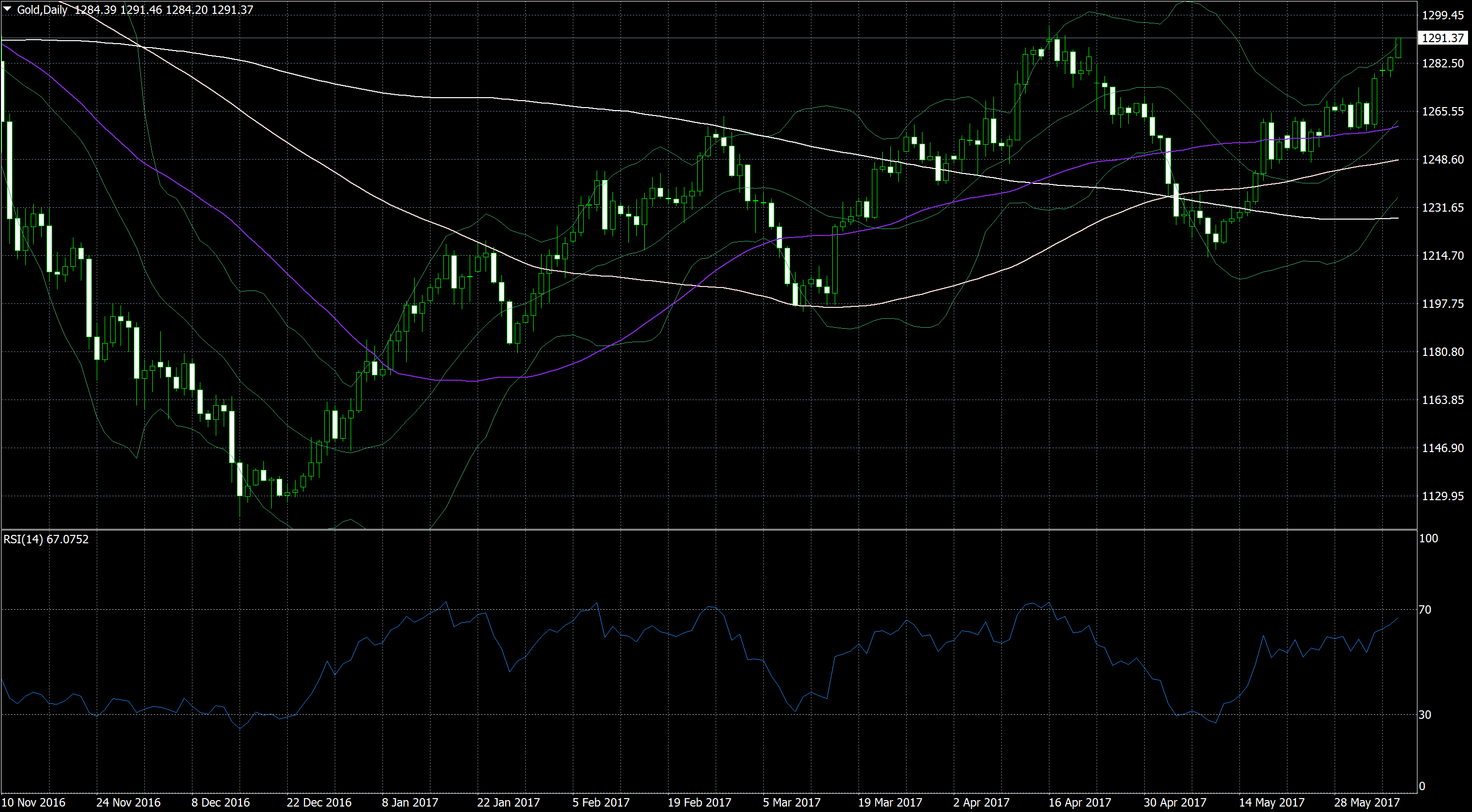

To understand what is happening to gold in June 2017, consider this chart:

This is a daily chart. It features three moving averages (50-days, 100-days, and 200-days), Bollinger Bands, and the Relative Strength Index (RSI).

The chart tells us a few things:

- The market is in an uptrend. Each last high has been higher than the previous high, and each low has been higher than the previous low.

- The moving averages are stacked to confirm upwards momentum. The 50-day moving average is closer to the market than the 100-day moving average, which is closer than the 200-day moving average. This stacking confirms the strong upwards momentum.

- The market nears the price level of the previous high. The market is getting ready to break through the previous high.

- The RSI is nearing the overbought area but has still room upwards. The RSI is closing in on the overbought area, but this is normal during uptrends. The current value of 66 leaves enough room to the maximum value of 100 for the market to continue to rise.

- The 50-day moving average provides strong support from below. The 50-day moving average is close to the market. In the past, it has provided strong support, which means that the market has little room to fall.

- The last candlesticks indicate an upwards momentum. Three of the last four candlesticks indicate a strong upwards momentum. We have a big candle, a candlestick that close at the upper end of its range and one (the current one) that has no wick to the bottom.

How To Trade These Predictions

Binary options offer the ideal tools to take advantage of the current gold market. Here are a few trade ideas that you can try:

1. Trade the market breaking through the previous high

When the market moves past the price level of the previous high, it confirms the current uptrend. Many traders use this event to invest in rising prices, which leads to a strong demand that pushes the market upwards. Take a look at the previous swings, and you will see that the market created strong upwards periods every time it climbed past the previous high.

When this event happens again, you can expect another strong upwards movement. Depending on your risk tolerance, you can trade this movement with high/low options (low risk, low reward), one touch options (medium risk, medium reward), or ladder options (high risk, high reward).

We recommend using at least a one touch option. The movement is well-predictable, which is why the risk of a one touch option is still low.

2. Gold trading: A long-term high option

The market is unlikely to fall. It is trending upwards, and the three moving averages provide a strong support. The odds of winning a long-term high option are good. Time you option so that it expires before the market enters the next downwards swing, or after it has already started to swing upwards again.

3. Trade a short-term high option

You can trade the strong upwards momentum indicated by the last candlesticks with a short-term high option. Keep you expiry shorter than one candlestick.