What does the Trump victory mean for Gold prices?

The expectation following Donald Trump’s victory in the US Presidential election was that gold prices would surge, perhaps as high as $1,500 an ounce. However, in the second full trading session after the vote, gold slid to $1,280 and dipped even lower on the London Stock Exchange at $1,256.

Trump touted a $1 trillion infrastructure spend during his campaign, which led many to believe that interest rates will rise. Inflation is bad news for non-yielding gold, which traditionally struggles in these trading conditions. As James Steel, metals analyst for HSBC told Reuters, the expected pro-growth policies of the new administration will boost yields of paper-based assets at the expense of the yellow metal.

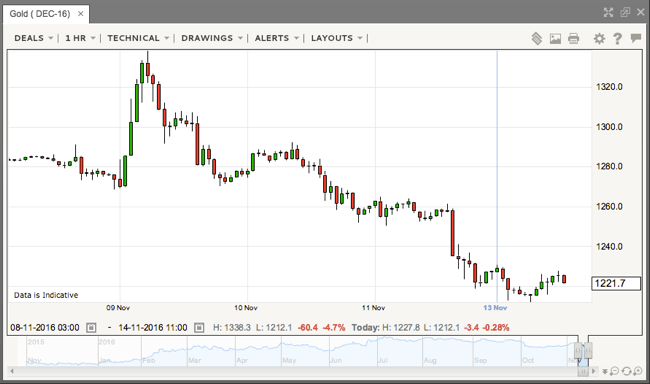

Gold Price chart (1hr, Nov 8th to 13th)

An initial spike as the Trump victory was announced, was followed by a steady decline in the price of Gold over the next few days.

Gold demand falling

Legendary hedge fund manager Stanley Druckenmiller ditched his gold stocks on election day, saying he has bet on economic growth. He told CNBC that all the reasons he had owned gold over the last few years – the virtues of which he was espousing back in May at the Sohn conference – are about to come to an end, and on a global scale.

Calling interest rates ‘a beach ball that has been held underwater by central banks’, Druckenmiller is acting on the expectation that central bankers worldwide will have difficulty scooping up assets to stimulate growth. In an increasingly bullish market, he is shorting German government bonds and UK government gilts, in the assumption that Mr Trump will be guided by Paul Ryan’s ‘A Better Way’ plan for economic growth.

Recovering dollar a negative for Gold outlook

The president elect’s speech seems to have calmed a jittery market, but it’s been bad news for gold – long considered a safe haven in times of financial stress – particularly as the dollar continues to regain ground after its earlier dramatic slump. The yellow metal is often hedged against the dollar.

So what might President Trump’s policies mean for gold in the long term? For now, the markets are buying his promises on growth and gold is slumping. However, Goldman-Sachs still have faith in the yellow metal as a hedge and are advising investors to look to gold for the medium to long term in a portfolio context.