CMC markets are an established CFD and spread betting broker, trading on the London Stock Exchange ( as CMCX).The company is one of the world’s leading online financial trading operators, serving retail and institutional traders through regulated offices in 14 countries, with a large presence in the UK, Australia, Germany and Singapore. They provide an award winning next generation trading platform and as a broker operating in the UK, are fully regulated by the Financial Conduct Authority (FCA).

In April 2016, CMC added binary trading to their offering and these are now offered via the same cutting edge trading portal as their other financial products.

Commenting on the launch, David Fineberg, Director of Trading, CMC Markets said: “I’m really excited about our new binary offer which has been completely developed in-house. Our ambition was to offer clients an intuitive, feature-rich experience that worked across all devices via one account, combined with the exceptional levels of reliability and servicing that clients expect from CMC Markets”.

Key info for CMC;

- Demo Account – Yes

- Minimum Deposit – £0 (No minimum)

- Minimum trade – £.50

- Signals service – No.

- Bonus details – None.

- Mobile App – Yes. Compatible across all platforms.

Trading Platform

CMC offer binary trading under two headings, with different payout mechanisms. ‘Countdowns‘ are fixed payout binaries, but for very short term expiries (From 30 seconds up to an hour), payouts range from 80% to 85%. ‘Binaries’ are traded on an exchange, and run over 5 minutes, an hour, daily or weekly. Payouts will vary based on the price taken at the point of the trade. We look here at both products.

Countdowns

Available from the products menu down the left hand side, Countdowns will be more familiar to binary traders who have used brokers elsewhere. The window will open a grid of assets, and each can be selected to trade. Once chosen the price graph will be displayed. CMC provide a huge range of technical analysis tools above the price graph, these can all be tailored to suit, as can the layout of the graph itself.

To the right are the trading buttons. The expiry and trade size both need to be selected, after which the ‘Below/Above’ buttons will become available. Clicking once presents the confirmation screen, and the second click places the trade. Once placed, the trade appears in the open positions list, along with a countdown to expiry – and the current status and potential payout. Just to the right on the open positions is the ‘history’ tab, which will list recent closed trades.

Binaries

Again, Binaries can be found on the left in the products menu. The layout is similar to Countdowns (and throughout the site), so the first screen is a grid of available assets. Again, the price graph is then displayed – along with all the additional tools. What differs significantly is the trading area. CMC Binaries are traded over an exchange, so traders need to pick their price level and then ‘buy‘ or ‘sell‘ at that level. The price level is traded between 0 and 100, where 0 represents a trade finishing ‘out of the money’, while a market will settle at 100 when ‘in the money’. Prices can be traded right up until expiry, so traders can take profits if an asset moves in the right direction – and cut losses when they do not.

To place a trade, the user needs to click the buy or sell price at the required price level. The price level and trade size then need to be confirmed before clicking the ‘Place order’ button and confirming the trade. Again, confirmed deals appear in the ‘Open’ positions area.

Trader choice

As a new offering, it would have been easy for CMC to scale back their initial launch, but instead they offer a full range of assets, across four different types of options;

As a new offering, it would have been easy for CMC to scale back their initial launch, but instead they offer a full range of assets, across four different types of options;

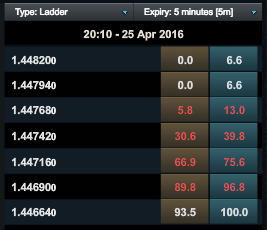

- Ladders – (Pictured) A popular binary product that allows traders to speculate on whether the settlement price will be at or above a chosen strike level, in a certain timeframe

- One Touch – allows traders to speculate on the settlement price reaching a specified strike price during the binary timeframe

- Up/Downs – provides traders the opportunity to speculate on whether the settlement price will be at or above the previous period’s close at the end of the binary expiry

- Range – traders can speculate whether the settlement price will be within a specified range when the binary expires

Mobile App

CMC pride themselves on providing state of the art trading tools and that extends to the mobile offering.

CMC pride themselves on providing state of the art trading tools and that extends to the mobile offering.

The mobile app is supported across the full range of mobile platforms, including android and iOS. The application is a full version of the website, offering access to over 9500 assets. The app allows traders to update and monitor positions, stream live prices, apply stop loss or other risk management, view detailed charts, edit account preferences, deposit or withdraw funds and even get in touch with the support team during trading hours. It does it all.

The mobile app is industry leading, and does leave many rivals behind. If mobile trading and staying up to date with trading news whilst on the move is key to traders, then CMC have them covered.

Payout

The payouts with CMC Markets are difficult to compare – the binary trading is offered over a genuine exchange. The countdown (short term) options payout between 80% and 85%. The binaries however, payout depending on the level that the trader was able to open the trade at. For example, if a trader brought at 50 and the make up was 100, the payout is effectively 100% (for a £1 position, they risked roughly £50 and got paid £100), but if they brought at 70 and the make up was 100 then the payout dips to around 50% (The amount risked was greater and the gain was smaller). A better comparison is the margin – the difference between the buy and sell prices – CMC have a margin of roughly 4% (or 4 ‘points’) on the binary markets. This, combined with the ability to trade at any point, makes CMC substantially cheaper than any other binary options brokers.

Withdrawal and deposit options

As a broker that is regulated by the FCA, CMC have strict controls on deposit and withdrawal methods, and this in turn, ensures greater protection for the trader and their funds.

There is a £0 minimum deposit requirement at CMC markets, though you must have sufficient funds in your account to open trades. The amount required differs depending on the asset, but minimum trades per point vary between 50p and £10. The amount required to open a trade will be made clear before a trade is confirmed and is referred to as the ‘Margin required‘.

Deposits can be made via debit or credit card but these must be in the name of the individual (not a commercial card for example). Payments made from third party cards will be returned. Non-UK cards may incur further charges. Bank transfers are also accepted, these must be in the same name as the individual on the trading account. Deposits can also be made via the same options over the mobile apps. Deposits over the telephone are only accepted where a margin call has been made.

Withdrawals are a strength at CMC. Available from the ‘Payments’ menu, withdrawals requested before 14:00 will be processed the same day for UK accounts (Outside of the UK, requests need to be made before 11:00 in order to be completed the same day).

In order to comply with FCA regulations, CMC may request further details of proof of identity. Likewise, if setting up bank details to make a withdrawal, CMC will need proof of ownership. It is best to organise this prior to making any withdrawals – this will speed up the process when a request is made.

Other Features

CMC Markets offer their clients the following features and benefits:

- Spread betting, CFD and Forex – CMC are leading brokers in other forms of investment besides binary options.

- Reuters News – Market updates and news events direct from Reuters (Live accounts only)

- MorningStart reports – Detailed equity research reports from MorningStar.

- Cash rebates – Earn cash rebates on certain trades and markets.

- Education Seminars and Webinars – CMC markets offer a range of educational material across all of their products.