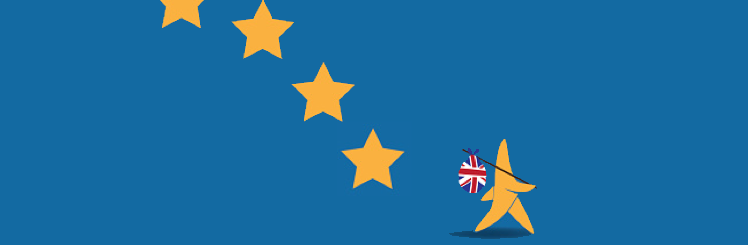

Sterling has had a rocky few months. After dropping immediately after the Brexit vote, it has swung significantly in recent weeks following various pieces of news and rumours surrounding the Brexit negotiations.

It looks increasingly possible that the European Council could declare that insufficient progress has been made when they meet to discuss Brexit in December. That would mean that the talks will be unable to move into phase 2, which will involve the discussion of a future trading relationship between the UK and the EU in March at the earliest.

This could be very problematic for the UK as many companies have stated that they will activate their ‘No Deal’ contingency plans if progress is not made by the end of 2017.

Some Positives For UK

Nonetheless, many of the standard measures that economists use to measure economic performance have posted relatively strong readings in recent months. Unemployment remains at record lows and consumer spending figures are looking fairly healthy.

The two main worries for the economy besides the Brexit negotiations are the continuing flatlining of productivity numbers and the sluggish growth in wages. However, for the next six months or so, what happens next with Brexit remains the major issue.

If the major players are happy to simply wait a little longer, this would mean very little to the movement of the pound. Most likely, it will continue to sit at the unexceptional levels that it has stuck to since the Brexit referendum.

Productive Sectors To Move?

On the other hand, traders could begin to take fright at the prospect of UK unemployment increasing if the Brexit negotiations do not proceed smoothly. The UK’s productivity has hardly grown in 15 years and some of the most productive sectors leaving the country could tip the economy into a downward spiral. This could quickly put pressure on the UK’s negotiators to capitulate to the EU’s demands, meaning that sterling could rebound relatively quickly in these circumstances.

Brexit negotiations remain a great unknown. However, as crunch time approaches it’s becoming more important that traders start to map out the path that the markets will take following the UK’s exit from the EU.