BKTrading (Baumann & Krauss Trading) are a new binary options broker, who began operating in early 2015. They use the familiar spotoption platform, used by other established firms. As yet, BKTrading are not regulated by CySec or any other body, and do not comply with MiFID. Due to not falling within the MiFID guidelines, they are able to offer trading to US based traders.

The main focus of BKTrading is on the trader experience, but what currently sets them apart from other brokers is the very low minimum deposit, at just £10. Plus the 10% refund for options finishing out of the money (losing trades).

Here are some of the other key details about the BKTrading brand;

- Demo Account – No

- Minimum Deposit – £10

- Minimum trade – £5

- Signals service – No.

- Bonus details – 100%.

- Mobile App – No.

Platform Features

BKTrading offer a familiar looking trading platform, based around the Spotoption model.

BKTrading offer a familiar looking trading platform, based around the Spotoption model.

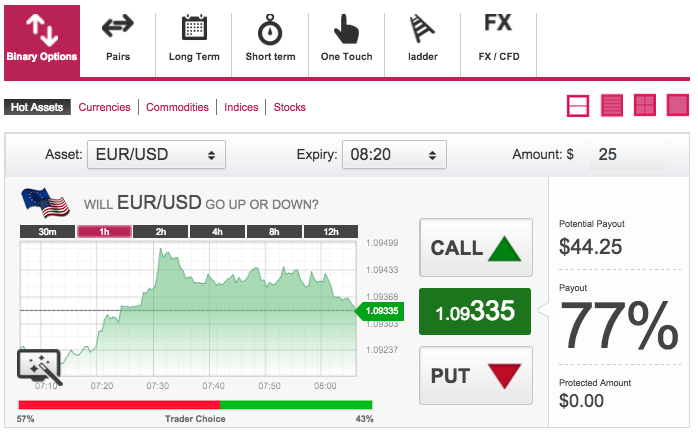

The option type is the first decision for traders (there is more detail about each option type below). Traders are then able to select the asset category they are interested in. To the right of the asset categories are four icons which allow traders to configure the trading area to their own preference – ranging from a single trading window with full detail, up to a set of rows, giving access to numerous assets at once.

Beneath the asset categories is the specific asset choice, alongside that is the expiry time and trade amount (the minimum trade with BKTrading is just £5). Both can be changed as needed. Under the trading parameters is the price graph for the asset. The time frame can be amended so that trends can be more easily identified. Along the bottom is a ‘trader choice‘ bar, illustrating the direction that trader sentiment is currently leaning. On the price graph is a ‘Strategy advisor’ – this overlays some common technical analysis tools over the current price graph, and offers trading advice based on the outcome.

To the right of the price graph are the trading buttons. The potential payout is displayed just below the amount and will update automatically if that amount field is changed. Beneath that is the payout and the ‘protected’ amount – this will display when it is applicable. Just to the right of the payout information are the trading buttons. As with everything else, they are clearly identified, the Call and Put buttons include the relevant arrows, and the strike price is positioned between them – this changes colour to reflect the most recent price change, up (green) or down (red).

Selecting either trade button will bring up the ‘trade approval‘ window, which is an opportunity for the trader to double check details of the trade. Confirming the approval will trigger the trade and it will then appear in the ‘Open positions’ window of the trading area.

The ‘Open Positions / Expired Positions’ window sits beneath the trading windows and allows traders to track all of their open and closed trades. These are grouped into the trade types with all the relevant details for each trade listed below.

Trading choice

BKTrading offer options on forex, commodities, stocks and indices. Their asset lists are pretty comprehensive. Indices are the largest list. Coupled with the largest range of trading options of any broker, it means traders using BKTrading will not be short of choice.

They offer seven kinds of option:

Binary Options – The basic binary option. Will the asset rise in value, or fall?

Pairs – How will two assets perform versus each other? Generally pairs are made up of two related stocks (e.g. BMW vs Daimler), but can also be provided against commodities (Gold vs Silver for example) or indices.

Long term – The same as a traditional binary option, but with much longer term expiry times, generally weeks or months.

Short Term – As the name suggests, very short term binary options with very short expiry times. BKTrading cater for 60,90,120,180 and 300 second expiry times.

One Touch – Will an asset price ‘touch’ a particular value at least once before the expiry time? At BKTrading, only the ‘touch’ option is available (there is not a ‘no touch’ option). The target price is often some distance from the strike price – so payouts can get very large – up to 1000% – which some traders may find useful during volatile periods.

Ladder – Ladders offer a series of price levels which can be traded in both directions. As the levels rise or fall relative to the strike price, the payouts can get larger if a large price movement is required in order for the trade to finish in the money.

Forex – This is an option offered by very few brokers, so is a great addition for BKTrading. It allows traders to trade currency pairs ‘per pip’, setting stop losses and target prices. It is an innovation that brings traders closer to genuine Forex trading than the simpler form of binary options.

Mobile

BKTrading have yet to develop a mobile trading app.

Payout

Payouts at BKTrading are very competitive. The most traded assets see payouts of around 77%. As ever, the payouts will vary based on expiry times and the asset selected. Higher payouts are available with different trading options too. For example, ladder or one touch options will offer significant payouts for larger price moves. Forex also works ‘per pip’, so can generate higher payouts if desired.

Withdrawal and deposit options

Deposits to BKTrading can be made via credit card (Visa, Mastercard, Diners and American Express). Wire transfer is possible, but carries a £500 transaction minimum – plus a £25 charge. A transfer is also subject to delay, which means the funds may not be available to trade immediately. The minimum deposit via credit card is just £10 – The initial deposit will dictate which account type a trader moves into (see table). £10 gains entry to the ‘Basic‘ account, £1,000 the ‘Standard‘ and so on – up to the ‘VIP‘ account – which sees traders paid an additional 3% across all trades;

Deposits to BKTrading can be made via credit card (Visa, Mastercard, Diners and American Express). Wire transfer is possible, but carries a £500 transaction minimum – plus a £25 charge. A transfer is also subject to delay, which means the funds may not be available to trade immediately. The minimum deposit via credit card is just £10 – The initial deposit will dictate which account type a trader moves into (see table). £10 gains entry to the ‘Basic‘ account, £1,000 the ‘Standard‘ and so on – up to the ‘VIP‘ account – which sees traders paid an additional 3% across all trades;

Withdrawals are also handled based on the account type, with VIP accounts having withdrawals processed immediately.

Withdrawals are available via the same processes as a deposit – but there is a £100 minimum. Traders must provide certain documentation before a withdrawal can be processed, here are the stipulations as laid out by BKTrading;

1. ID Picture: This can be any public document such as passport or driver’s license.

2. An address proof, like a receipt within the last 6 months of a public utility bill.

3. A copy of the credit card used for the investment must be sent. For your own security, please cover your card number on the front of the card, leaving only the last 4 digits visible, and also cover the CVV number on the back of the card, leaving the signature visible.

The withdrawal process lags behind other binary option brokers but is sure to make large improvements as the firm matures.

Other Features

BKTrading offer their clients the following features and benefits:

- TA Wizard – Technical analysis tool, available on the price charts.

- Range of Educational material – Includes seminars, books, financial reports and even one to one training

- 24/7 Support