Strategy is a key element of long term successful binary options trading. The best binary trading strategies can be defined as: A method or signal which consistently makes a profit. Some strategies might focus on expiry times, like 60 second, 1 hour or end of day trades, others might use a particular system (like Martingale) or technical indicators like moving averages, Bollinger bands or breakouts.

Traders just want a strategy that works. Novice investors might be interested in the 3 binary options strategies for beginners laid out in the “Strategies For Beginners” section. More advanced traders can find forex strategies, scalping or arbitrage tips and mt4 strategy. Whatever you are looking to learn about strategy, you will find here.

This page provides a definitive resource for binary trading strategy. No more searching for books, pdf, videos, software downloads or ebooks! These pages list numerous strategies that work – but remember:

A Guide To Strategy

When trading binary options, a winning strategy requires a method that wins more trades that it loses, and crucially, at a payout that more than covers the losses. Digital trades generally payout at less than 100% on the investment amount – so simply winning more trades than are lost may not necessarily be enough to turn a long term profit.

The art of trading binaries profitably shares some similarities with the sports betting world. The important trait that links both enterprises is that of expectancy. Long term profit trading binaries can only be derived where the expectancy (the theoretical profit within any trade) results in a positive expectation from that trade.

Binary options trading strategies are therefore used to identify repeatable trends and circumstances, where a trade can be made with a positive (profitable) expectancy. It may be as simple as;

- If asset ‘X’ falls in value for three sessions in a row, open a call option for the duration of the next session.

The above is an extremely simple example of a trading ‘strategy’. Strategies do not need to be hugely complex (though they can be), sometimes the simplest strategies work best.

Types Of Trading Strategy

There are a range of techniques that can be used to identify a binary options strategy. New investors may like to explore all of them – each has the ability to be profitable when used correctly.

In addition to the type of basic, or traditional, trading strategy highlighted above, there are also alternative methods;

- Charting and technical analysis charting (the analysis of graphs and other technical indicators) is often considered first when discussing strategy. Much has been written about the trends and patterns that are regularly seen within the pricing charts, and many of these can translate directly into trading strategies. Retaining a simple strategy whilst trying to drill into technical analysis is not always easy, but does provide a route to some insight that may not be immediately obvious elsewhere.

- Fundamentals – Analysis of the fundamentals is almost a prerequisite for most types of investment or trading. With binary options trading however, the time scales are often too short for the fundamentals to shift the price in the expected direction. There are still some binary options trades that can be gleaned from study of the fundamentals though, and it is another potential route for a successful strategy. Particularly longer term options. Some brokers now offer expiry times of one and two months ahead making this form of strategy much more realistic.

See why price action is important.

The Benefits Of Good Trading Strategy

A good binary trading strategy will simplify much of the decision making about where and when to trade. With timing the key to everything where trading is concerned, the less guess work there is around entry and exit points, the better. Particularly for less experienced traders.

A repeatable strategy will always highlight the trading opportunities, where otherwise, the majority of those openings would be missed. Strategies encourage discipline, aid money management and provide the clearest predictor for positive expectation. While it is possible for traders to profit from binary options without a strategy, it will be exponentially harder.

Novice traders will also benefit simply from trying to build their own binary options trading strategy. Once some time has been spent analysing different methods and building a strategy from scratch. It is much easier to appraise strategies offered by others. Without that initial grounding in the art of trading strategies, it would be very easy to become intoxicated by the promise of untold riches using someone else’s trading strategy or expensive software.

Demo accounts can be a good place to start experimenting with binary options trading strategies without risking any capital. Read our full list of demo account brokers here.

Leading Brokers:

Elements Of A Profitable Strategy

There are three binary strategy elements every trader must know. In this article, we present each type strategy and examples for beginners and advanced traders.

In detail, you will learn:

- Which types of binary options strategies are there?

- Why do I need a trading strategy?

- Why do I need a money management strategy?

- Why do I need an analysis and improvement strategy?

- With this information, you will immediately be able to pick the right strategies for you and become a successful binary options trader.

Sub-Strategy Choices

To create a successful binary options strategy, you have to combine three sub-strategies:

- A trading strategy

- A money management strategy

- An analysis and improvement strategy.

Each of these strategy does a very specific thing for you. To be successful, you need all three. If you lack one, the other two become useless.

Let’s take a look at each type of sub-strategy and see how you can find the right one.

Why Use A Strategy?

The trading strategy is the most famous type of sub-strategy for binary options. It is so famous that many traders make the mistake of thinking that it is the only strategy they need. But more on that later. For now, let’s focus on how you can find a good trading strategy.

A trading strategy helps you to find profitable investment opportunities. It defines which assets you analyze, how you analyze them, and how your create signals.

For example, a trading strategy could define that you trade only big currency pairs between 8 and 12 in the morning, that you use a 15 minute price chart, and that you invest when a 10 period moving average and the Money Flow Index (MFI) both indicate the same direction – for example, the moving average has to point up, and the MFI has to be in an oversold area, or vice versa.

The great advantage of such a definite strategy is that it makes your trading repeatable – you always make the same decisions in the same situations.

Value Investing

This way of trading is crucially important to your success because binary options are a numbers game. Financial investments, in general, include the risk of losing trades, but the short time frames of binary options are especially erratic. You can never be completely sure what will happen next. Even the best traders will win only 70 to 80 percent of their trades, those with high-payout strategies might even turn a profit with a winning percentage of 30 percent.

Successful trading does not mean to be always right. It means to be right often enough to turn a profit. Think of a coin flip. When you win 50 percent of your trades and get twice your investment on winning trades, you know that you would break even after 100 flips. If there were some way for you to increase your winning percentage to 60 percent, however, you knew that you would make money. The same applies if there were a way to increase your payout. Your trading strategy does exactly this for your binary options trading.

Strike Rate

When you trade high/low options, for example, you can expect an average payout of 70 to 75 percent. This means you need to win 60 percent of your trades to make money. A trading strategy helps you to identify situations in which you know that if you always invest according to your strategy, you will win at least 60 percent of your trades and make a profit.

Without a concrete trading strategy, you would never know if you would win enough trades to make a profit. On some days, you might get lucky and make a lot of money, but on others, you would lose half of your account balance. Sooner or later, you would have a bad day and lose all of your money.

With a trading strategy, you can avoid such a disaster. A trading strategy is a crucial cornerstone of long-term trading success.

Why Use Money Management?

A money management strategy is the second cornerstone of your trading success. To understand its purpose, let’s get back to the example of the coin flip. Even if you have a strategy that gets the odds in your favour, for example by guaranteeing that you will win 60 percent of the flips, this strategy will lead to disaster if you always bet all your money on every flip. You might win the first one, but you will soon lose a flip, and all your money will be gone.

To prevent bankruptcy, you have to limit your investments. This is the first purpose of a money management strategy.

The second purpose is to help you adjust your investment according to your capabilities. Let’s get back to the coin flip with a strategy that wins you 60 percent of your trades and look at a number of possible money management strategies that would fail:

- Always invest the same amount. If you start with £100 and invest £1 on every single trade, you would make a nice profit in the beginning. You would also have enough room to survive a streak of bad luck. As your account balance increases, however, your investment would soon get too small. Once you reach the £1,000 mark, for example, winning a £1 trade will hardly make a difference. The problem with this type of money management is that it fails to grow with you.

- Invest the way you feel. Some traders vary their investments based on their intuition. When they feel or have won their last trades, they invest more. This strategy is dangerous because losses weigh heavier than wins. When these traders lose a few trades in a row and have invested a little more on these trades, they have lost a large percentage of their overall account balance. They have to significantly reduce their investment, which makes it difficult for them to make it back. Step by step, they lose more and more money. The holes they dig for themselves will always be bigger than your ability to get out of them.

- Invest more after a loss. Some traders increase their investment after a loss, for example by doubling their investment. They hope to eventually win a trade, make a profit, and start the cycle anew. Such strategies work great – until they fail. Even if you choose a very small starting investment, binary options enable you to make so many trades that you will be broke within a year.

Lessons In Managing A Bankroll

What can we learn from these examples of failing strategies? There are three lessons:

- You need to adjust your investment to your overall account balance.

- You have to have a precise definition of how much you invest and increase your investment in proportion to your overall account balance.

- You must reduce your investment after a losing trade and increase it after a winning trade.

To fulfill all three of these criteria, a good money management strategy always invests a small percentage of your overall account balance, ideally 2 to 5 percent. For example, if you decide to invest 2 percent per trade, you would invest £2 with an account balance of £100. If your account balance increases to £200, you would invest £4 per trade and so on.

Whether you should invest 2 percent or 5 percent on every trade depends on your risk tolerance and your strategy. Investing more can make you more money, but losing streaks will be more expensive. We recommend using a demo account to find the right setting for you.

Analysis And Improvement Strategy

An analysis and improvement strategy is the most overlooked sub-strategy you need. It helps you to find the weak points in your trading and improve over time. Without an analysis and improvement strategy, long-term success is at least difficult, if not impossible.

When you get started in binary options, you still have a lot to learn. That means you have to try different strategies, vary the parameter of each strategy and make improvements. This might sound simple, but it is very difficult to figure out what works for you and what does not. There are so many variables that it is almost impossible to connect all the dots.

Without an analysis and improvement strategy, newcomers lose themselves in the endless complexity of trading. An analysis and improvement strategy makes this complexity manageable.

Defining Analysis

There is no precise definition of what your analysis and improvement strategy should look like, but by far the most common approach is using a trading diary. In a trading diary, you note every aspect of your decisions. After you invested, you write down which indicators you used, which time frame, which asset, and which expiry. You also write down your location, your mood, the time of the day, and your trading device. Once the trade is finished, you note the result.

After a while, you can analyse your diary. You might find that you won significantly more trades in the morning in the afternoon, that you are a better trader with your phone than with your PC, or that you can interpret moving averages more effectively than candlestick formations.

Spot Trends To Identify Strengths And Weaknesses

Regardless of what you find, the result helps you to focus on the elements of your trading strategy and your money management that work for you and eliminate everything else. You will get better and better, and eventually, you will be good enough to turn a profit. Keep writing your diary anyway, and you will be able to recognise mistakes creeping in before they cost you a lot of money.

In theory, anything can be your trading diary. Some traders take screenshots, others keep an Excel file, and some write old-fashioned books. Pick the diary that works for you, and you will be fine.

Sub-Strategy Conclusion

A binary options strategy is your guide to trading success. While it can seem difficult to find the right strategy at first, with the right information, things are rather simple. You need a trading strategy, a money management strategy, and an analysis and improvement strategy, and you will be fine.

Specific Strategy Examples:

60 Second Expiries

This basic strategy aimed at 60-second (Listed as 1 minute options at some brokers) goes as follows:

1. Find support and resistance levels in the market where short-term bounces can be had. Pivot points and Fibonacci retracement levels can be particularly useful, just as they are on other timeframes while trading longer-term instruments.

2. Take trade set-ups on the first touch of the level. When you are trading assets that have a high level of ‘noise’. I believe that taking a higher volume of trades can actually play to your advantage. 60 second / 1 minute trades certainly fall into this category.

For those who are not familiar with this form of analysis on longer term expiries: The advice is to look for an initial rejection of a price level already marked ahead of trading. So marking support and resistance is a vital. If it does reject the level, this helps to further validate the robustness of the price level. Trade on any subsequent touch. This will lead to a lower volume of trades taken in exchange for higher accuracy trades. The first touch is not traded, but used to validate following trades. So less trades, but more accurate.

60 Second Trades Lead To Higher Trade Volume

Since the inherent noise in each 60-second trade is so large to begin with, I believe trading more often can actually work to the trader’s gain. In that it helps to even out the accuracy fluctuations that come when trading such short-term expiry times.

Overall accuracy of ‘in the money’ trades will drop. This means lower expected value from each trade. Higher volume however, can compensate.

For example, 100 trades with an expected profit of 1.25 would return 125 (Profit of 25). But 200 trades with a lower value, say 1.18, would net 236 (Profit of 36). So a lower strike rate does not always mean lower profit if more trades can be found over the same period.

Let us take a different view. If you’re trading 60-second options, and only taking 1-2 trades in a 4+-hour session (i.e., being super conservative). It is very likely that you are going to be waiting a long time before your true trading skill level becomes clear.

I could be that you are not profitable using 60 second options. It is better to find that out sooner, rather than later.

3. Don’t blindly trade all touches of support and resistance. Continue to consider price action (e.g., candlestick types and formations), trend direction, and momentum. Also be open to ‘gut feel’. Your trading experience will continue to grow, and your ‘feel’ for the markets will improve. On occasion, those instincts can over-ride any other signal. But bear in mind many trading lessons are learnt the hard way – with losing trades.

Momentum Strategy

The momentum is an important indicator of the speed with which the price of an asset moves. For binary options traders, it can be both a great way to find trading opportunities and a helpful tool to pick the right binary options type for the current market environment.

What Is A Momentum Strategy?

The momentum is a technical indicator that compares where the price of an asset now to a price in the past. There are different ways of calculating the momentum:

- Absolute. This way compares the current price to a price in the past and ignores everything in between. The most popular absolute interpretation is the momentum indicator, which compares the closing price of the last period to the closing price 14 periods ago (you can also choose any other number, but 14 is the default setting).

- Process oriented. This way of analysing the momentum considers every period and calculates the distance which the average period has moved. Many technical indicators calculate this value in slightly different ways, but the most popular of them is the Average True Range.

- Relative. Some indicators compare the current momentum of the market to a historical average. These indicators help you understand whether the current market environment is better suited for binary options types that create higher payouts but require strong movements (for example one touch options or ladder options) or for their low-risk alternatives that can win trades with smaller movements but create lower payouts.

Most of the time, these indicators display their result as a percentage value of the average momentum, with 100 being the baseline.Both indications are similar, but also very different. Let’s see how you can use them to trade binary options.

How Can I Trade A Momentum Strategy

Binary options offer a number of great strategies to trade the momentum. The simplest of them uses the momentum indicator and boundary options.

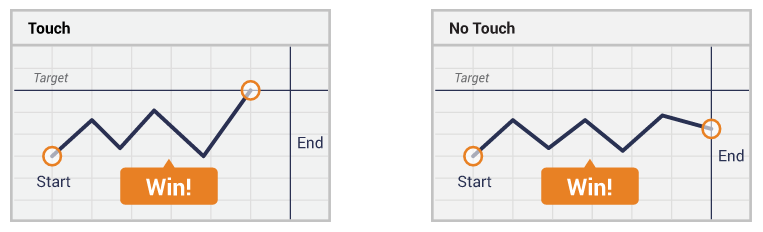

Boundary options are such a great way of trading the momentum because they are the only options type that enables you to win a trade on momentum alone. Boundary options define two target prices, one above the current market price and one below it. Both target prices are equally far away, and you win your option as soon as the market touches one of the target prices.

This means it is unimportant where the market moves, as long as it moves. The momentum can help you make this prediction. Assume that an asset is trading for £100. Your broker offers you a boundary option with target prices at £99 and £101, and when you adjust your momentum to meet your expiry, it reads 2.

Now you know that the market has moved twice as far in the recent past as it would have to move to win your boundary options. This seems like a good investment opportunity. If the momentum were only 0.5, you know that this would be a bad time to invest.

5-Minute Strategy

A good 5-minute strategy is one of the best ways of trading binary options. To get it right, there are a few things you need to know.

What Is A 5-Minute Strategy?

A 5-minute strategy is a strategy for trading binary options with an expiry of 5-minutes. While there are thousands of possible 5-minute strategies, there are a few criteria that can help you identify those that are ideal for you. In the eyes of many traders, 5-minute expiries are the sweet spot of expiries.

- The market does not move as random as on shorter time frames, which reduces your risk.

- You can still make a lot of trades in a day, which increases your earning potential.

5-minute expiries are as short as possible but as long as necessary. A 5-minute strategy allows you to take advantage of this perfect connection. Let’s take a look at two possible 5-minute strategies. Strategy 1: Trading MFI extremes with high/low optionsWith one exception, all 5-minute strategies are based on technical analysis.

Over the next 5 minutes, fundamental influences are unimportant – for example, no stock will rise because the company behind it is doing well. The only thing that matters is the relationship of supply and demand on the stock exchange –whether traders are currently buying or selling. Technical analysis is the only way of understanding this relationship. One of the technical indicators that can best describe the relationship between supply and demand is the Money Flow Index (MFI). The MFI compares the numbers of assets sold to the number of assets bought and generates a value between 0 and 100.

- When the MFI reads 0, everybody who wanted to trade the asset wanted to sell it.

- When the MFI reads 100, everybody who wanted to trade the asset wanted to buy it.

- When the MFI reads 50, the number of traders who wanted to sell the asset was exactly equal to the number of traders who wanted to buy it.

The relationship between buying and selling traders allows you to understand what will happen to the price of the asset next. Since the price is determined by supply and demand, a strong movement where too many have already bought or sold exhausts one side of this relationship. The market has to turn around.

- When too many traders have already bought an asset, there are too few traders left to push the market upwards. Demand will exhaust, and the market will fall.

- When too many traders have already sold an asset, there are too few traders left to push the market downwards. Supply will exhaust, and the market will rise.

The MFI helps you to identify these situations:

- When the MFI reaches a value over 80, the market is overbought. It will likely start to fall soon.

- When the MFI reaches a value below 20, the market is oversold. It will likely start to rise soon.

Binary options offer you the ideal tool for trading this prediction:

- Invest in a low option when the MFI reaches a value over 80.

- Invest in a high option when the MFI reaches a value below 20.

This strategy work especially great as a 5-minute strategy. During long-term trends (one year or longer), the MFI often stay in the over- or underbought areas for long periods. Fundamental influences are strong on these time frames and can keep pushing the market in the same direction for years. On shorter time frames, fundamental influences are unimportant. It is more important to identify the number of traders that are left to buy or sell an asset and draw the right conclusions from this indication.

The MFI is the perfect tool for this diagnosis, and binary options are the ideal way of trading it.

5 Min Strategy 2: Trading the news

If you feel uncomfortable with a strategy that uses only a mathematical basis for its prediction, there is one alternative to technical analysis as the basis of a 5-minute strategy: trading the news. When important news hits the market, there usually is a quick, strong reaction. You can trade this reaction with a high/low option, one touch option, or ladder option, depending on your preference and tolerance of risk. This strategy works well as a 5-minute strategy because longer expiries face the threat of other events influencing the market and causing a price change. For the next 5 minutes after the release of important news, however, you can be sure that the news will dominate the market.

Rainbow Strategy

The rainbow strategy for binary options combines sophisticated predictions with simple signals. It is ideal for traders who want to increase their profits by using a proven, successful strategy.

What Is A Rainbow Strategy?

A rainbow strategy is a three moving averages crossover strategy. Most traders use a different colour for every moving average, hence the name ͚rainbow͛ strategy. The idea behind the rainbow strategy is simple. Moving averages that use many periods for their calculation take longer to react to price changes than moving averages that use fewer periods.

During a strong movement, multiple moving averages should, therefore, be stocked from slowest to fastest in the direction of the current market price.

- The fastest moving average should be the closest to the current market price.

- The second fastest moving average should be the second closest to the current market price, and so on.

When you see multiple moving averages stacked in the right way you know that the market has a strong sense of direction and that now is a good time to invest. This is the basic logic of the rainbow strategy. Theoretically, you could use as many moving averages as you like for this strategy, but the rainbow strategy use three. Three is a good sweet spot because it keeps things accurate yet simple enough to handle.

Adding more indicators would create no significant increase in accuracy, but using only two moving averages would be much less accurate without simplifying things. These three moving averages determine when you invest.

- When the shortest moving average is above the medium moving average which is above the longest moving average, you invest in rising prices.

- When the shortest moving average is below the medium moving average which is below the longest moving average, you invest in falling prices.

You could use any number of periods for each moving average. There are two rules of thumb you should at least consider, though:

- Double the number of periods for each moving average.If your fastest moving average uses 5 periods, use 10 and 20 for the slower ones, for example. This ratio guarantees that the moving averages are different enough to create meaningful signals yet similar enough to create some signals at all.

- Use popular values. A trading week has five days, which is why using multiples of five is a good idea for this strategy. These values help you see the same trading opportunities as other traders, which increases the supply and demand that others will create to your advantage.

How to trade a rainbow strategy with digital options

To trade the rainbow strategy with binary options, you have to wait for your moving averages to be stacked in the right order. When that happens, you have three options for when to invest:

- Invest right away. Some traders invest immediately when the final moving average positions itself in the right order. This way of trading the rainbow strategy creates the most signals, which is why it offers the most potential but also the highest risk.

- Wait a period. Some traders wait if the moving averages remain in the order until the next period is over. If it does, you have lost little time but gained a lot of security because you know that the signal was more than the result of a sideways movement.

- Wait for two or more periods. Some traders wait until two or more periods have confirmed the signal. Waiting for too long, however, reduces the accuracy of your signal because the market might have already started to turn. We recommend to wait no longer than three periods or ignore the signal. You can trade this strategy with high/low options, one touch options, or ladder options. High/low options are the safest way; ladder options have the highest potential. Decide which binary options types is right for you based on your personality, especially your risk tolerance.

Rainbow Strategy Video From IQ Option

End Of Day Strategy

An end of day strategy for binary options can find you profitable trading opportunities while only requiring a very limited time investment.

End Of Day Strategy Explained

The end of day strategy is less of a strategy that tells you which signals to use and more of a strategy that tells you when to look for signals. The strategy assumes that the best time of the day to trade is at the end of the day.

The end of the trading day shows some unique characteristics. This is mostly due to the fact that day traders stop their trading when a stock exchange is about to close.

Day traders are traders that never hold overnight positions. They invest for the short run and argue that a lot can happen overnight, which is why it would be unwise to hold a position during this time.

Since there are a lot of day traders out there, their absence significantly reduces the trading volume. The market is a bit slower and does things it is unlikely to do at any other time of the day. Traders with an end of day strategy wait for this environment, arguing that signals are clearer and trading opportunities better.

Trading End Of Day Options

While you can theoretically trade any trading strategy at the end of a trading day, there are a few strategies that work especially well during this time. Let’s take a look at the most profitable of them: trading closing gaps.

Closing gaps are especially likely during times with low volume, which is why the end of the trading day is the best time of the day to trade them. The accurate predictions of closing gaps make them especially attractive to traders of binary options types with a higher payout such as one touch options.

A gap is a jump in price action. For example, if an asset traded at £100 and jumped to £100.1 without covering the range in between (without trading for £100.01, £100.02, and so on), it creates a gap of £0.1.

Depending on how this gap was created, it can mean different things. A gap that was accompanied by a high volume likely is the result of significant news reaching the market, which probably starts a strong new movement. Near the end of the trading day, however, such gaps almost never happen.

What we find instead are gaps that are likely to close.

Near the end of the trading day, there are so few traders left in the market that a few traders, possibly even a single trader, are enough to make the market jump. The resulting gaps are weak because they are the result of a single person’s decision. Most other traders will consider the advance unjustified and invest in the opposite direction:

- If the gap points upwards, most traders will consider the new price too high. They will sell their assets.

- If the gap points downwards, most traders will consider the new price too low. They will buy new assets.

Because of both reasons, gaps that happen near the end of the day are likely to close.

This knowledge allows you to trade a one touch option. When your broker offers you a one touch option with a target price inside the reach of the gap, you know that the market will likely reach this target price. If the expiry is reasonable, too, invest.

Alternatively, you can also trade a high/low option that predicts a closing gap.

Expiry Strategy

Base Line Expiry

I learned a long time ago how to judge the duration of a given signal. Well before I began trading binary options. Here I will explain how to develop an expiry strategy.The first thing to do is to identify what your signal is.Is it a:

- trend line bounce

- stochastic crossover

- shift in momentum

- candlestick pattern

- or a combination

Once done, you go back over your charts for a given period and identify all the signals. The time frame is not important at this point, this technique works in all. Mark the strong signals and weak signals. Now count how many bars or candles it takes for each signal to move into the money.

Once that is done you can take an average of the number of bars needed. Both for the strong and for the weak signals to move into the money. These averages are now your base line expiry for the signal. If you are using a chart of hourly prices and your signal takes an average of 3.7 candles to move into the money, you will want to use an expiry that coincides with that time. This could be a mid day, end of day, 4 hour or other option. Whatever expiry matches your signal horizon. If the signals takes 3.7 candles and you are using a daily chart that means 3.7 days. If using the hourly chart, it means 3.7 hours, and so on.

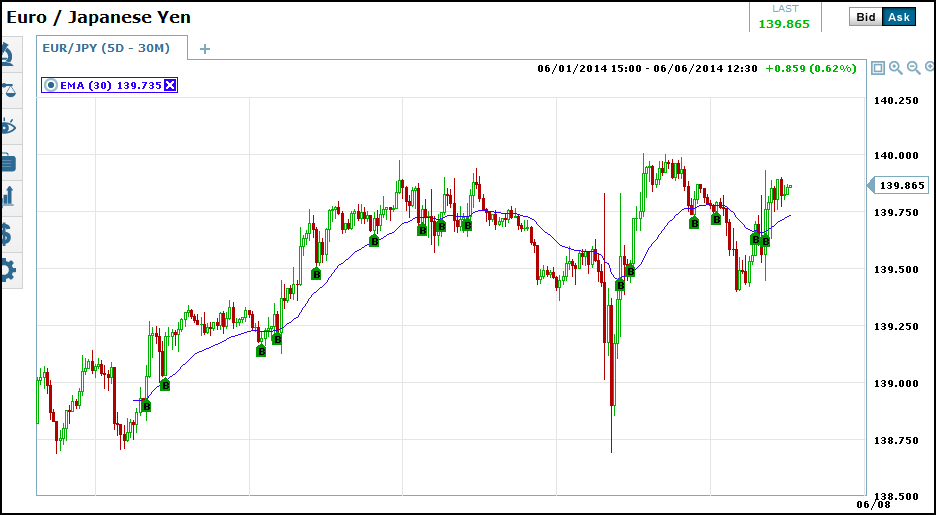

Study the chart below. I am going to use a basic moving average strategy to demonstrate. I will use the 30 bar exponential moving average. It hugs prices closer than a simple moving average and will give us more signals to count.

Also, in order to weed out bad signals and to improve results, I am only choosing the bullish trend following signals. So, there are 15 total signals. 6 weaker signals and 9 stronger signals. On average, it takes 4.2 bars for these signals to move into the money and reach a peak.

That means, since this is an hourly chart, that each signal will move into profitability and reach the peak of that movement in about 4 hours. So for expiry I would want to choose the closest expiry to 4 hours that is available. If a good choice is not available then no trade can be comfortably made. Do not try and force trades where they do not fit.

Breaking it down a little, the weak signals peak out in about 2.6 hours versus the stronger signals. Stronger signals take about 5.3 hours. Putting this knowledge in perspective, a weaker signal might be one that is close to resistance. A stronger signal might be one that is not close to resistance. Also, a stronger signal might be one where price action makes a long white candle and definitive move above or from the moving average whereas a weaker one might only create small candles and spinning tops.

Additional Tips For Choosing Binary Options Expiry

Choosing an expiry is one of the most important factors in making a trade. The other key factor being direction. All too often I get asked questions about why a trade went bad in the final moments. One of the most common areas of error I find is in choosing expiry.

Of course there can also be errors in analysis, trends or random events. But the focus of this discussion is expiry. It is obvious that you don’t want to use 60 second expiry when trading on weekly charts. Just as clearly, you won’t want to use end of day expiry when trading off the 60 second charts. So how do you determine what the best expiry will be?

One question you must ask yourself is: if you are trading with or against the trend.

When trading against the trend I would suggest a shorter expiry than a longer one. Simply because there is less chance of an extended move counter to the trend. Your expiry must be more precise. When you trade with the trend your expiry can be a little farther out.

A trend following trade has a higher likelihood of closing in the money so does not need to be as precise. A signal that follows the trend is a lot more likely to be in the money rather than one that goes against the trend.

Another factor that can have a big impact on which expiry is best for a given trade is support and resistance. The relative level of prices to a support or resistance line is a factor in how likely a trade is to move in a given direction.

If prices are near a S/R line and moving away there is much more chance of your option closing in the money than if prices are near a S/R line and moving toward it. When prices are moving toward one of these lines, the chances of the movement being halted and/or reversed is much higher than when prices are moving away from one.

So, how does this apply to expiry? If you are taking a signal that has a higher chance of being halted or reversed then you would want to choose a shorter expiry than if the same signal were not faced with a S/R level. I purposefully did not say call or put, or bullish or bearish, because this applies to both bullish and bearish trading. Also, keep in mind that support and resistance can be in the form of lines drawn at areas of interesting price action or peaks, moving averages, Fibonacci’s, envelopes and bands.

1-Hour Strategy

Binary options can make you a profit of 70 percent or more within only 1 hour. Compare that to stocks, and you understand why binary options are so successful. To trade 1-hour strategy with binary options, there are a few things you have to know. This article explains them.

In detail, you will learn the three crucial steps to trading a 1-hour strategy with binary options, which are:

- Step 1: Finding the right indicators

- Step 2: Finding the right time frame

- Step 3: Finding the right binary options type

With these three steps, you will immediately be able to create and trade a successful 1-hour strategy with binary options.

Step 1: Finding The Right Indicators

The first step to trading a 1-hour strategy with binary options is deciding which type of indicator you want to use to create your signals.

To find the right indicator for you, there are a few things you have to consider:

- Your skills. Some strategies are ideal for traders with great pattern matching skills; others are ideal for traders who are great with numbers. To create a successful strategy, you have to match your strategy to your skills.

- Your character. Some indicators create many but risky signals; others create reliable but few signals. Depending on your risk tolerance, you should pick the type of indicator that helps you sleep at night and not get bored.

- Your daily schedule. Some indicators require you to trade during a specific time of the day. Traders of closing gaps, for example, can find the best signals during the slow market environment of the ending trading day. Additionally, some indicators require more time to analyse than others. Make sure to choose an indicator for which you have enough time, and that fits your schedule.

With these criteria clearly defined, let’s take a look at a few indicators for each type of trader. To keep things simple, we will focus on strategies that you can trade during the entire day. We will later mention a few strategies that you can only trade during special times.

As our main criteria, we will divide strategies into pattern-matching and numerical strategies.

- Pattern-matching strategies require you to find certain patterns in the movements of an asset’s price,

- Numerical strategies require you to interpret numerical values.

Additionally, we will distinguish strategies into high-reward and low/risk strategies, and into quick and detailed strategies.

- High-reward strategies are risky but have a lot of potential, low-risk strategies are safe but have a limited potential.

- Quick strategies require less time, but you have to blindly trust your indicators, detailed strategies leave more work to you, but it will be easier for you to trust your signals.

Let’s see how different strategies match these criteria.

| Pattern matching strategy | Numerical strategy | |

| High-reward, quick | Simple candlestick analysis. This strategy trades special formations that consist of only one to three candlesticks. Finding these formations is quick and easy, but they lack the reliability of more complex signals. Because there are so many candlesticks, however, executing this strategy well will win you more trades than with other strategies. | Trading extreme areas of the MFI. The Money Flow Index (MFI) creates a value between 0 and 100 that indicates the strength of a movement. Values over 80 indicate that the market has little room left to rise, values under 20 indicate that the market has little room left to fall. All you have to do to trade these predictions is invest in a low option when the market reaches a value over 80 and a high option when the market reaches a value under 20. This strategy can create many signals, but since it is based on a single technical indicator, it is also risky. |

| High-reward, detailed | Swing trading. During trends, the market alternates upwards and downwards movements. Swing traders try to take advantage of each of these movements. This strategy will provide you with many trading opportunities during a trend, but trading a single swing is always riskier than trading the trend as a whole. | Trading the ATR & the ADX with boundary options. The ATR calculates the average range of past movements, the ADX its strength of direction. With both values, you can predict whether the market has enough energy to reach one of the target prices. This strategy can create many signals and create a high payout, but is also risky. |

| Low-risk, quick | Three moving average crossovers. Combining three moving averages can create highly secure signals. You have to do almost nothing to execute the strategy. Simply sit back and wait for your software to create a signal. On the downside, this strategy will create few signals, which limits its potential. | Trading MFI divergences. When the MFI’s movement fails to mirror the market, the current trend is deep trouble. For example, when the market creates a new high during an uptrend but the MFI fails to create a new high, too, the market will soon turn downwards. You can take advantage of this prediction by investing in a low option. This strategy can create secure signals with little time investment. |

| Low-risk, detailed | Continuation & reversal patterns. Continuation patterns are large price formations that allow for accurate predictions. These patterns are rare, but you can win a high percentage of your trades. | Combining multiple technical indicators. On their own, all technical indicators are unreliable. But when you combine multiple indicators, you can filter out bad signals and create a more reliable strategy. For example, it makes sense to combine the MFI with the RSI or the ADX. These strategies will create fewer signals because you filter some of them out. |

Step 2: Finding The Right Time Frame

Once you have found the right indicator, you have to think about which time frame to use. We are creating a strategy with an expiry of 1 hours, which gives you the first indication. Depending on which indicator you are using, however, you should trade a very different time frame.

The time frame of your chart defines the amount of time that is aggregated in one candlestick. When you are looking at a chart with a time frame of 15 minutes, for example, each candlestick in your chart represents 15 minutes of market movements. When you are looking at a chart with a time frame of 1 hour, each candlestick represents a 1 hour of market movements.

When you create your signals in a chart with a time frame of 15 minutes, you create different signals than in a chart with a time frame of 1 hour. To trade a successful 1-hour strategy, you have to find the type of signals that is perfect for your indicator.

For a 1 hour strategy, every indicator requires a specific time frame that matches the expiry to the time for which the indicator’s predictions are valid. Let’s look at our pattern-matching examples:

- Simple candlesticks work best with a time frame of 1 hour. Simple candlesticks consist of only one to three candlesticks, which is why their predictions only apply to the next candlestick. After that, other influences are likely to override the candlestick, and it loses its predictive power. Therefore, you have to make sure that you only trade predictions that expire within the next candlestick. With a 1 hour expiry, this means using a 1-hour time frame.

- For swing trading, keep your time frame around 5 to 10 minutes. Swings need some time to develop. When you trade a chart with a time frame of 5 minutes and an expiry of 1 hour, you give the swing 12 candlesticks to develop. This is a good value for most trends. If you find that your timing is a little off, you can try a 10-minute chart, too.

- Three moving average crossovers work best with a time frame of 1 to 5 minutes. When you trade three moving average crossovers, you are looking for a movement that contains many candlesticks. It is probably best to trade three moving averages on a 5-minute time frame, too, but if you want to give your movements more time, you can also switch to a 1-minute chart. Everything else would be too long or too short, respectively.

- Reversal and continuation patterns provide plenty of opportunities. You can trade continuation and reverse patterns by trading the long movement they indicate or by trading the short breakout that occurs after the completion of the pattern. In the first case, you should use a time frame of 5 to 10 minutes to give the movement enough time to develop. In the second case, you should trade a time frame of 4 hours or even 1 day to make sure that you are truly trading the breakout and not a lot more.

As you can see from this list, the type of indicator predetermines the time frame you have to use for a 1-hour expiry. Some indicators predict where the next candlestick will go, in which case you need a long expiry to adjust the length of one candlestick to your expiry. Other indicators predict long movements, in which case you have to trade a shorter time frame to give the market enough time to develop an entire movement.

This rule also applies to the numerical strategies:

- Trading the MFI’s extreme areas works best with a time frame of 5 to 10 minutes. This strategy allows for two trading styles. Some traders like to invest when the MFI enters an extreme area; some invest when it leaves the extreme. The first type has to use a shorter time frame to give the market more time, ideally 5 minutes. The second type can trade a longer time frame, ideally 10 minutes.

- For MFI divergences, use a 1-minute or 5-minute time frame. When the MFI diverges from the market, it can take a few periods until the market catches up. To create these signals in an environment that is ideal for a 1-hour strategy, keep the time frame short. 1-minute or 5-minutes charts provide the ideal environment for this strategy.

- For multiple technical indicators, use a 15-minute chart. When you combine multiple technical indicators, you create signals short to medium signals. These work best with a time frame of 15 minutes. Of course, your ideal time frame depends on your final strategy and the technical indicators you use. If necessary, adjust your time frame.

These recommendations are a good place to start for each strategy. Please remember, though, that they are only recommendations. Every trader is different, and if you should find that you can achieve better results with a different time frame than our recommendation, use whatever works. There is no right and wrong aside from what makes you money or loses you money.

Step 3: Finding The Right Trade Type

After you have matched your indicator to a time frame, you have to match it to a binary options type. Binary options offer many different types, and each type has its unique relationship of risk and reward.

To explain how binary options types relate to your strategy, let’s take a closer look at the different option types. You will see that it is difficult to give general recommendations, but some binary options fit some strategies better than others.

- High/low options are the classic option type with which you can predict whether the market will rise or fall over a period, in our case 1 hour. Because high/low options can win you a trade with the smallest possible movement in the right direction, they are the low-risk way of trading that works for all of these strategies. Executed well, each strategy should win you a high enough percentage to make a profit.

- One touch options define a target price, and you win your option when the market reaches this target price. The market does not have to remain at this target price, which is a great advantage, but you need a stronger movement because the target price is further away. One touch options are a good fit for trading the breakout of continuation and reversal patterns and those simple candlesticks that predict strong movements, for example the big candle. The might also

- Ladder options define multiple target prices and allow you to define whether the market will close above or below each target price. They allow for risky predictions that can create the highest payouts of all binary options and for secure predictions that allow a high winning percentage. Especially traders of pattern-matching strategies might be able to profit from this premise disproportionally.

- Boundary options are one touch options with two target prices, one above the current market price and one below it. Obviously, boundary options are ideal for trading the ATR and the ADX. Boundary options are the only options type with which you should trade this strategy. For all other strategies, boundary options are a bad fit. These strategies all provide clear predictions for where the market will go. Boundary options do not require you to predict a direction, which means that you waste a part of your prediction. If you traded a one touch option, you would get a higher payout and win just as many trades.

1-Hour Strategies That Require Special Trading Times

The beauty of all strategies in this post is that they work well in any market environment and at any time. Consequently, any trader can use them. However, there are also strategies that specialize in a specific trading environment or a specific time. These strategies might be a better fit for traders who plan on trading these environments anyway.

The most prominent example of this type of strategy is trading closing gaps. Gaps are jumps in market price when the market jumps from one price level to a much higher or much lower price level.

- When gaps are accompanied by a high trading volume, they can indicate the beginning of a new movement or the strengthening of an existing one. Many traders back the gap, and there is enough momentum keep pushing the price into the direction of the gap.

- When gaps are accompanied by a low trading volume, they are likely to close. Few traders back the gap, and most traders are likely to consider it an unjustified advance. They will invest in the opposite direction, and the gap will close.

The beauty of closing gaps is that they provide you with one of the most accurate predictions that you can find with binary options. The gap will likely close within the next period, which gives you an exact expiry, and the gap’s size gives you a clear target price.

Alternative Trade Types

With this information, you can trade a one touch option or even a ladder option. You get a high payout and you should be able to win a high percentage of your trades, which means that you have a powerful strategy at your hands.

The downside of this strategy is that gaps that are accompanied by a low volume are difficult to find during most trading times. There are simply too many traders in the market to create a gap with a low volume. Therefore, low-volume gaps mostly occur near the end of the trading day.

Many traders are day traders. They close their position at the end of the day and never hold a position overnight. These traders will stop trading when the market is about to close because there is not enough time to make another trade.

Trading Hours

When day traders have left the market, the trading will drop off significantly. Now you can find closing gaps. Monitor all time frames from 15 minutes to 1 hour, and trade any gaps you find with a one touch option with an expiry of 1 hour that predicts a closing gap.

Traders who work during the day and can only trade after work can use this strategy to make a profit despite their work.

The important point here is that you can trade successfully, even if your time is limited. If you have to trade during your lunch break, you can find successful strategies for this limitation, too.

As with anything in life, success means making the most of your limitations. With binary options, your limitations might help you to trade more successful than if you had none.

1 Hour Strategy Overview

A 1-hour strategy is one of the most popular types of trading strategies. It combines an expiry that seems natural to us with a wide array of possible indicators and binary options types, which means that every trader can create a strategy that is ideal for them.

Whether you prefer a pattern matching or a numerical strategy, a high-potential or a low-risk approach, and a simple or a complex prediction, you can create a 1-hour strategy based on any combination of these attributes.

Unless you are trading boundary options with the ATR and the ADX, we recommend starting with high/low options – they are the easiest type for newcomers.

Double Red Strategy

The double red strategy is a simple to execute strategy that allows binary options traders to find many trading opportunities. Here’s how you execute it.

What Is The Double Red Strategy?

The double red strategy is a trading strategy that wants to identify markets that feature falling prices. The ͞double red͟ in the name refers to the fact that the strategy waits for two periods with falling prices in a row before it creates a trading signal – periods with falling periods are often coloured red in trading charts.

The logic is simple: at significant price levels, the market often takes some time to sort itself out. After it has sorted itself out, however, the falling price movement is often stronger and more linear than an upwards movement, which is why it is a great investment opportunity.

For example, assume that there is a resistance. When the market approaches this resistance, it will never turn around immediately. It will edge itself closer and closer, test the resistance a few times, and eventually turn around. While the turnaround would be a great trading opportunity, finding the right timing is difficult. During the process of edging closer and closer to the resistance, the market will already create a few periods with falling prices that will fail to lead to a turnaround. You have to avoid investing in these periods.

To find the right timing, the double red strategy waits for a second consecutive period of falling prices that confirms the turnaround. When such a period occurs, the market has obviously stopped moving around the resistance and has started to move away from it again. Double red traders would invest now.

How To Execute The Double Red Strategy

To execute the double red strategy with binary options, here’s what you do:

- Choose a short period for your chart. Binary options are short-term investments, and your chart’s period should reflect that. Choose a period somewhere between 5 minutes and 1 hour.

- Find a resistance level. Sometimes, you will find a resistance level directly in the chart. If the price itself offers no resistance levels, you can add technical indicators. Bollinger Bands and technical indicators with significant numbers of periods (20, 50, 100, 200, for example) usually offer great resistance levels that will influence the market.

- Invest when you find two red periods in a row. Once the market approaches the resistance, monitor price movements closely. Once you see two periods in a row, predict falling prices. Most traders use low options for this strategy.

If you add another indicator (the Average True Range, for example) and like to a take a little more risk, you can also use one touch options or ladder options.

Keep your expiry short. The double red strategy creates signals based on two candlesticks, which means that its predictions are only valid for very few candlesticks, too. Ideally, you would limit your expiry to one or two candlesticks. For example, on a 15-minute chart, you would use an expiry of 15 to 30 minutes.

Strategies For Beginners

We have the three best strategies for beginners, from high-potential to risk-averse

- What do beginners need to know?

- A risk-averse strategy: following trends

- A high-potential strategy: trading swings

- An intermediate strategy: trading gaps

With this information, you can find the best strategy to start trading binary options as complete newcomer.

What Do Beginners Need To Know?

Binary options strategies for newcomers must fulfil some special criteria. They must be simple but effective, quick to understand but profitable. There are many complicated strategies that can make money if a trader executes them perfectly.

Beginners, however, will be overwhelmed, make mistakes, and lose money. The goal of a good strategy for newcomers to create similarly positive results while simplifying the strategy.

Let’s take a look at a few strategies that can fulfil these criteria. We will present a risk-averse strategy for those traders who want to play it safe, a riskier strategy for those who want to maximise their earnings, and an intermediate version.

Risk-Averse Beginners Method: Following Trends

Following trends is a secure, simple strategy that even newcomers can execute. Trends are long lasting movements that take the markets to new highs and lows.

- Movements that take the market to new highs are called uptrend,

- Movements that take the market to new lows are called downtrends.

The trick with trends is understanding that they never move in a straight line. An asset’s price is determined by the relationship of supply and demand, and there is no perfect movement where supply always exceeds demand or vice versa. It is simply possible for all traders to keep buying or selling continuously. There must always be brief periods during which the market gathers new momentum.

These periods are called consolidations. During a consolidation, the market turns around or moves sideways, until enough traders are willing to invest in the main trend direction.

The alternation of movement and consolidation creates a zig zag line in a particular direction. This is a trend.

- An uptrend takes the market two steps up, then one step down, and then two steps up again. And so on.

- A downtrend takes the market two steps down, then one step up, and then two steps down again. And so on.

Finding Trends

When you look at the price charts of stocks, currencies, or commodities that have risen or fallen for long periods, you will find trends behind all of them. Trends can last for years, but the more you zoom into a price chart, the more you will find that every movement that appeared to be a straight line when you looked at it in a daily chart becomes a trend on a 1-hour chart. What seems to be a straight movement in a 1-hour chart becomes a trend on a 10-minute chart, and so on.

There are many levels of trends. Regardless of which time frame you want to trade, there is always a trend you can find.

To follow a trend once you have identified it, you have a few different options:

- Invest in a high/low option: This is the simplest strategy. When you recognise an uptrend, invest in a high option; when you find a downtrend, invest in a low option. Choose your expiry about as long as a full cycle. If an uptrend takes 30 minutes to create a new high and low, choose an expiry of 30 minutes. Then, the market should definitely be higher than now. If you want, you can also use an expiry twice or three times as long as a cycle. Just stay with a multiple of the typical cycle length. Once you are comfortable with this strategy, you can think about monitoring failure swings with the Money Flow Index (MFI) and Relative Strength Index (RSI) to evaluate the remaining strength of a trend or adding a moving average to your strategy.

- Invest in a one touch option: Once you have found a trend, you can predict the speed with which the market will rise or fall. For example, if you know that a trend has increased an asset’s price by £0.1 every 15 minutes, you can calculate the trend’s trajectory and invest in a one touch option. When your broker offers you a one touch option with a target price £0.15 away from the current market price and an expiry of 30 minutes, you know that there is a high chance that the market will reach this target price. Find a trend, check your broker’s one touch options, and if you find one within reach, invest.

- Combine both strategies: You can also combine both strategies. When you find a trend, invest in a high/low option in trend direction and calculate whether it makes sense to invest in a one touch option. If so, invest in both options; if not, stick with the high/low option alone.

Since these are relatively safe strategies, you can afford to invest a little more on each trade. We recommend somewhere between 3 and 5 percent of your overall account balance.

High-Potential Beginners Strategy: Trading Swings

Trading swings is a variation of our first strategy, following trends. A swing is a single movement in a trend, either from high to low or vice versa. Every cycle of a trend consists of two swings: one upswing and one downswing.

Instead of trading a trend as a whole (like trend followers), swing traders want to trade each swing in a trend individually.

The advantage of this strategy is that every trend provides them with multiple trading opportunities, not just one.

More trading opportunities mean more potential winning trades, and more winning trades mean more money.

The downside of this strategy is that trading a swing is riskier than trading a trend as a whole. You are trading a higher potential for a higher risk – if that is a good idea depends on your personality.

- Some traders lose interest if they trade only one option in a trend. They are in danger of straying from their strategy and making bad decisions. These traders would do better with a swing-trading strategy.

- Some trades will get nervous when they follow the third or fourth consecutive swing in a trend. Afraid that the trend will end soon, they will stray from their strategy and make bad decisions. These traders can do better by following the trend as a whole.

Investing Levels

If you decide to become a swing trader, we recommend using a low to medium investment per trade, ideally between 2 and 3.5 percent of your overall account balance. Only traders who like to take risks should invest more, but never more than 5 percent of their overall account balance.

Choose your expiry according to the length of a typical swing. If you expect an upswing and a typical upswing takes about 30 minutes, use an expiry of 30 minutes. Choosing the right expiry is no exact science, and you will need a little experience to find the perfect timing.

To identify ending swings, you can use technical indicators. Momentum indicators such as the Relative Strength Index (RSI) or the Money Flow Index (MFI) are popular choices, just like moving averages.

The Intermediate Beginners Strategy: Trading Gaps

Trading gaps combines an intermediate risk with a good chance for high profits. The strategy is simple enough for beginners to learn it within a few hours.

Gaps are price jumps in the market. At the end of one period, something influenced the market strongly, and the price jumped to a higher or lower level with the opening price of the next period. Candlestick charts are ideal to find gaps because they clearly visualize the gap between one period’s closing price and the next period’s opening price.

Gap Types

The most common gap is the overnight gap. When the stock market opens in the morning, all the new orders that were placed overnight flood in. If traders were optimistic or pessimistic, there is a good chance that most of these orders point in the same direction. The market opens significantly higher or lower, and there is a gap between yesterday’s last price and today’s first price.

Such a gap is a significant event because the same assets are suddenly much more expensive. The market can react shocked, some traders might take their profits; or the market can push forward, providing the sense that this is the beginning of a strong movement.

To know how you can profit from gaps, you have to know these three types of gaps:

- Breakaway gaps. Breakaway gaps happen during sideways movements. In these periods, the market is unsure about where it wants to go and builds up momentum for the next movement. When prices jump up or down and this jump is accompanied by a high volume, the market has created enough momentum to start a new movement.

You can profit from this knowledge and invest in a high option in the direction of the gap. Since you are expecting a longer movement, choose your expiry longer than one period of your chart. If you are trading a 15-minute chart, for example, use an expiry of at least 15 minutes. - Acceleration gaps. Acceleration gaps occur during a trend. While the asset was already trending up or down, something must have happened that intensified this momentum. The market jumps in the direction of the trend and creates. In an uptrend, acceleration gaps always occur in an upwards direction; in a downtrend, acceleration gaps always occur in a downward direction.

Like breakaway gaps, acceleration gaps are accompanied by a high volume. Use a similar expiry as with breakaway gaps. Acceleration gaps also allow you to invest in a one touch option because, after the gap, the trend will move faster than before the gap. If your broker offers you a one touch option that would have been just out of the reach of the previous trend, you know that there is a good chance that the accelerated trend will reach it. This might be a good opportunity. - Exhaustion gaps. Exhaustion gaps are very different from the first two gap types because they signal an impending reversal. Exhaustion gaps occur during a strong movement in the direction of the movement – just like acceleration gaps. The difference between both gap types is that exhaustion gaps are accompanied by a low volume and that the market already begins to reverse during the period. After an exhaustion gap, the market is likely to close the preceding gap, which provides you with a great opportunity to trade a one touch option or a high/low option.

- Common gaps. Common gaps happen during sideways movements. They are accompanied by a normal volume and represent random movements with little long-term significance. Since common gaps are likely to close, you can invest in a one touch option or a high/low option.

Price Jumps

The basic principle of all four gaps is the same. Gaps are significant price jumps, which is why many traders now have an incentive to take their profits or enter the market. Both forces push in the opposite direction of the gap and are likely to close it. For a gap to remain open and create a new movement, the gap has to be accompanied by a high volume. This high volume indicates that many traders support the gap, and that there are few people who will take their profits or invest in the opposite direction immediately after the gap.

Beginners Strategy – Conclusions

Even complete novices and beginners can find a simple but effective strategy that could make them money.

- Risk-averse traders can follow trends as a whole.

- Traders who are willing to take risks if it increases their potential can trade swings.

- Traders who want a good mix of risk and potential can trade gaps.

Zero-Risk Strategy

With Binary Options A zero-risk strategy is the dream of any financial investor. While it is impossible with any investment, binary options can get you closer than anything else.

Is A Zero-risk Strategy Possible?

When you invest, there is always some risk. Despite all efforts to predict what the market will do next, nobody has yet found a strategy that is always right. Sometimes, the market moves in unpredictable ways and does things that seem irrational.

In hindsight, we often find good explanations for these events. As a trader, you have to avoid letting this hindsight bias confuse you. When a trading day is over, it is easy to say that this event moved the market the strongest. But when a trading day begins, it is often almost impossible to predict which of the many events of the day will have the strongest impact on the market and how it will influence the market. Even beyond the stock market, financial investments always include some risk.

- When you invest in securities with a fixed interest rate, there is always the chance that the bank that emitted them has to file for bankruptcy. Many countries protect your money up to a certain amount, but beyond that, the risk is yours.

- When you buy government bonds, there is always the chance that the government goes bankrupt. Since bonds have long expiries of up to 30 years, a lot can happen over this time.

Simply put: a zero-risk strategy is impossible with any asset. But binary options offer a few tools that allow you to get relatively close to zero risk. Let’s see how you can do that.

How To Get Close To A Zero-risk Strategy

Most binary options brokers offer a great tool: a demo account. Demo accounts work just like regular accounts but allow you to trade with play money instead of real money. In the risk-free environment of a demo account, you can learn how to trade.

You can try different strategies, find the one that suits you the best, and perfect it. You can wait until you switch to real-money trading until you have a solid strategy that you know will make you money by the end of the month. While many stock brokers offer a demo account, too, binary options have one great advantage: binary options work on a shorter time scale, which means that you learn faster and better.

- When you buy a stock, you have to wait for months or years until you know whether you made the right decision. In the meantime, many unique things happen, which is why you will eventually conclude that the situation is unrepeatable and you have learned nothing.

- When you trade a binary option, you know within a few minutes whether you have made the right decision. In the meantime, there are no events that distort your result. When your option expiries, you get a clear result. You know whether what you did worked or not. Because binary options work on such short time scales, they allow you to create and test a strategy much better than any other type of investments.

Once you have traded a strategy with a demo account and turned a profit for a few months in a row, you know that there is a very high chance that you will make a profit when you start trading real money, too. There will still be some risk, but binary options have helped you to eliminate as much risk as possible.

For those still looking for zero risk trades, Arbitrage is another option.

Breakout Strategy

The breakout strategy utilizes one of the strongest and most predictable events of technical analysis: the breakout.

What Is A Breakout?

Breakouts occur whenever the market completes a chart formation. These completions indicate significant changes in the market environment. The market will pick up a strong upwards or downwards momentum, which means that many traders have to react to the change.

- Some traders will close their positions because the event negates their predictions. When a trader predicted rising prices but an event indicates prices will fall, this trader will close their position before they lose money.

- Some traders will open new positions that point in the direction of the new trend.

- Many traders will do both. When a trader can predict where the market will go, there is no reason why they should not trade this prediction. Traders that realize that their original prediction was wrong will likely invest in the opposite direction.

All of these three possibilities create a strong momentum in the same direction.

- When the market completes a downwards formation, some traders will short sell the asset; some will sell their long positions. Both actions create downwards momentum.

- When the market completes an upwards formation, some traders will buy the asset; some will close their short positions. Both actions create upwards momentum.

Since most traders anticipate the payout, they will place orders that automatically get triggered when the market reaches the price level that completes the price formation. These orders intensify the momentum even more.

How Can I Trade The Breakout With A Strategy?

Digital options offer a number of strategies to trade the breakout. Here are the three most popular strategies:

1.Trading the breakout with high/low options. When you anticipate a breakout, wait until the market breaks out. Once it happens, invest in a high/low option in the direction of the breakout. If the breakout happens in an upwards direction, invest in a high option; if the breakout happens in a downwards direction, invest in a low option. Use an expiry equivalent to the length of one period. This is the low-risk/low-reward way of trading the breakout.

2.Trading the breakout with one touch options. Breakouts are strong movements, which is why they are perfect for trading a one touch option. One touch options define a target price, and you win your trade when the market touches this target price. Once you see the market break out, invest in a one touch option in the direction of the breakout. This is the medium-risk/medium-reward way of trading the breakout.

3.Trading the breakout with ladder options. When an asset breaks out, invest in a ladder option in the direction of the breakout. Choose a target price with which you feel comfortable but that still provides you with a high payout. This is the high-risk/high-reward way of trading the breakout. All of these three strategies can work. Choose the one that best matches your personality.

Three Strategies For Bollinger Bands

There are hundreds of strategies that use Bollinger Bands. Regardless of which strategy you use, there is almost no downside to adding Bollinger Bands to your chart. Even if you do nor trade them directly, having three additional lines will not confuse you. On the contrary, it will subconsciously influence to make better decisions.

Nonetheless, we will now present three strategies that not only feature Bollinger Bands but use them as their main component. Understand these strategies, and you will also be able to use Bollinger Bands in your strategy.

Strategy 1: Trading Outer Bollinger Bands With High/Low Options

This is the simplest strategy, and the one with the least risk. It can be explained in two simple steps:

- Compare the current market price to the price range of the Bollinger Bands.

- If the market is near the upper end of the Bollinger Bands, invest in falling prices with a low option. If the market is near the lower end of the Bollinger Bands, invest in rising prices with a high option.

That’s it. Even newcomers can immediately execute this strategy.

There is one thing you should know, though. Since every new period moves the Bollinger Bands, what is the upper range of the current Bollinger Bands might not be the upper range of the next periods. A quickly rising market will push the Bollinger Bands upwards, too; and a quickly falling market will take the Bollinger Bands down with it.

Because of this limitation, the strategy works best if you keep the expiry of your binary option shorter than the time until your chart creates a new period. If there are 30 minutes left in your current period and the market approaches the upper end of the Bollinger Bands, it makes sense to invest in a low option with an expiry of 30 minutes or less.

If you want, you can also double-check your prediction on a shorter period. Switch to a chart with a period of 15 minutes, and if the market is near the upper range of the Bollinger Bands, too, you know that there is a good chance that it will fall soon. If it is in the middle of this trading range, however, you might consider passing on this trade.

You might also consider upgrading this strategy to trade binary options types with a higher payout. By adding a momentum indicator, you can invest in option types that require a strong movement. To understand how to add this indicator, consider the example of our next strategy.

Strategy 2: Trading The Middle Bollinger Band With One Touch Options

The middle Bollinger Band has special characteristics. While it offers a resistance or support level, the market can break through it. When it does, the Band changes its meaning.

- When the market trades above the middle Bollinger band, the band works as a support. If the market breaks through this support, the middle band becomes a resistance. The market was trapped between the upper and middle bands and is now trapped between the middle and the lower bands.

- When the market trades below the middle Bollinger band, the band works as a resistance. If the market breaks through this resistance, the middle band becomes a support. The market was trapped between the lower and the middle bands, and is now trapped between the middle and the upper bands.

Both events change the entire market environment. When the market breaks through the middle band, it suddenly receives enough room to move to the outer band. This means you know the direction in which the market is likely to move and the distance, which is a great basis for trading a high-payout binary option.

Here’s what you do:

- Wait until the market breaks through the middle Bollinger Band.