Nadex is a regulated US exchange, as designated by the CFTC (Commodity Futures Trading Commission), and is legally permitted to accept US residents as members. Read how the Nadex spread works, and how to use the platform).

Providing a cutting edge trading environment, and advanced features, Nadex deliver a high quality trading experience. The disclosed exchange fee illustrates the transparent nature Nadex take to providing their service, which they describe as;

“Serving the function of matching buyers and sellers of a contract in an unbiased manner (Nadex does not profit from gains or losses on a trade, rather it simply receives a fully disclosed exchange fee)”

- Demo Account – Yes

- Minimum Deposit – $0

- Minimum trade – $1

- Signals service – No

- Mobile App – Yes, NadexGo.

Trading Platform

Nadex offer a genuine exchange. This means traders have the ability to buy or sell on either side of the market, but crucially, they can also set their own price. If another party is willing to take the other side of the option, then it will be struck at that price.

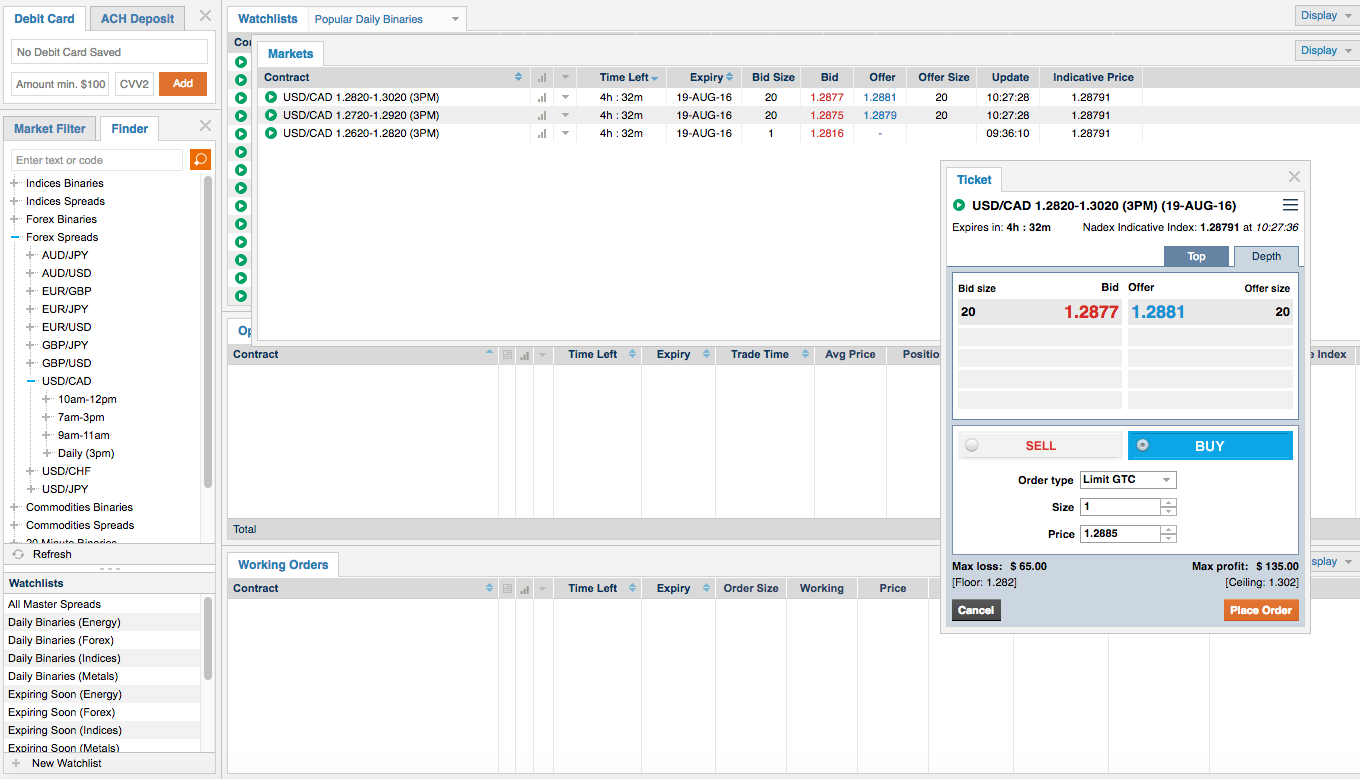

The first choice for traders to make is to select an asset to trade. This is done via the ‘Finder‘ window on the left of the trading platform. Selecting the relevant market opens up the time frames available for expiry of the option (times are listed in ET).

Once an asset and expiry have been selected, the ‘Markets‘ window will update. This will show the potential price levels that can be traded. For any given expiry period, there will be 10 or so price levels – for example, trading the S&P index offers 10 levels. Each level is traded based on whether the closing price (or price at expiry) will be higher or lower than the level stated. The make up on Nadex binary options is 0 or 100, so the exchange prices will fluctuate between the two. 100 represents an outcome that did happen, (for example the asset did finish above 1878) and the make up will be zero where the settled option did not finish in the money.

Clicking on the asset in the market list, or either the ‘Bid’ or ‘Offer’ figures – will open a trading ticket. Clicking bid or offer will mean the ticket opens with the ‘sell’ or ‘buy’ option pre-selected.

Clicking on the asset in the market list, or either the ‘Bid’ or ‘Offer’ figures – will open a trading ticket. Clicking bid or offer will mean the ticket opens with the ‘sell’ or ‘buy’ option pre-selected.

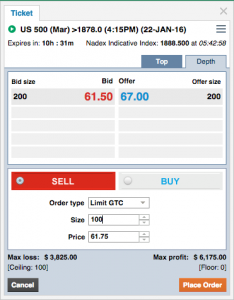

The trading ticket confirms expiry time, price level, bid size and the current bid and offer prices. Traders need to select the sell or buy buttons (if not already selected) and then enter the size (or investment level).

There are figures along the foot of the ticket that will confirm the maximum loss and maximum payout based on the size of trade entered. Traders can also amend the Price – this is the exchange element of trading.

Traders can set a price slightly higher or lower than the current levels to see if their position is ‘matched’.

As each option can be freely traded, traders can close their open trades at any time – so profits can be taken, or losses reduced. The maximum and minimum figures on the ticket represent the two outcomes if the option is left to expire without further trading.

Once the trade is configured as desired, traders click the ‘Place Order‘ button. If the trade is matched, it will appear in the Open positions window. If some or all of the trade is ‘unmatched’ it will move into the Working Orders screen.

Both windows will update as the order is matched. In addition to these windows, the platform will also send an email confirming details of the trade. An email is also sent confirming when an order is settled.

Trader choice

Nadex offer binary options on forex, commodities and indices, plus certain ‘events’ – a fed fund rate rise for example. They also offer spread markets on a similar range of assets.

There is a full range of price levels for each asset, so whether a trader is looking for a quick price move in a particular index, or a longer term trade in a currency pair, this firm will offer it.

The list of available trade types and assets is the largest of any of the binary options firms able to trade in the US. Over 500 contracts are available to trade.

Bitcoin Spreads

The Bitcoin Spreads let you trade the price of Bitcoin (based on the trusted TeraBit IndexSM) within a range, between a floor and ceiling price. As the price of bitcoins varies up and down, the Bitcoin Spread’s value moves as well, but with limits. If the underlying price of Bitcoin moves up above the ceiling or below the floor, the value of the spread stops moving and remains at its upper or lower limit (depending on whether you are a buyer or seller). In this way, your risk-reward is always limited and remains within a range you define. One limit is your profit target. The other is your guaranteed protection against unlimited losses. The duration of the contract is one week.

Mobile App

Nadex offer the most comprehensive mobile trading app on the market. The application is free, and has been optimised for a number of different platforms. Android and iOS versions are available, as are specific versions for tablets (again, both android and iPad) and also for windows phones.

The application is slick and most importantly, contains every feature available on the full website. From account maintenance to charting, everything is available in the trading app.

The layout is clear and concise, making trading very simple. The dealing ticket trading area appears almost exactly as it does on the website as it has already been optimised for ease of use.

The mobile trading app is one of the best in the sector, generates no complaints and cannot be faulted.

Payout

Operating a genuine exchange model, where traders are matched with each other, means traders can buy or sell options at any point between 0 and 100. True trading costs come from the spread:

Spreads

The payouts at Nadex are difficult to compare to other brokers (with the exception of IG) – no other binary options broker offers genuine exchange trading. The binary options payout depending on the level that the trader was able to open the trade at. For example, if a trader brought at 50 and the make up was 100, the payout is effectively 100% (they could have risked $50 for example, and received $100 when the trade settled), but if they brought at 70 and the make up was 100 then the payout dips to around 50% (The amount risked was greater and the gain was smaller). There is a charge of $0.09 per lot, (to a maximum fee of $9). These charges are clear and well documented, so provide more value than a more traditional option.

Withdrawal and deposit options

Nadex allow US residents to fund their accounts via debit cards, ACH transfer of wire transfer. Non-US residents can use debit card, or wire only.

Where a wire transfer is above $5000, the payments department will refund the $20 banking fee into the trading account.

Withdrawals are only available via ACH or wire transfer. Non-US residents can only use wire transfer. The withdrawal options can be found in the ‘Account funding‘ menu within ‘My Accounts‘. ACH transfer withdrawals are free and take roughly 3 to 5 days, while a wire transfer will require a $25 fee to be paid, but is generally processed the next day.

If deposits have been made via debt card, Nadex require certain security information before withdrawals can be processed (note withdrawals cannot be made back to debit cards). The firm also require 7 days after receiving the security information before accepting any withdrawal, so it is worth sorting this information out well before a withdrawal is required.

Withdrawal details are not straight forward with this operator, so it is worth clarifying them well before trying to retrieve monies. Many of these steps are required due to the CFTC regulations – but delays are a regular bone of contention among traders and their brokers – it is always an area to research thoroughly before funding an account. This ensures there are no surprises and traders know exactly what to expect when requesting a withdrawal.

Complaints

As one of only two brokerages allowed to trade binaries to US residents (via the CFTC), the firm run an honest business with high levels of transparency and customer service. As such, they generate very few complaints.

In volatile markets, traders can sometimes be “stopped out” (where their stop loss is hit, only for the price to recover). Some will assume this is some form of sharp practice by the broker, but in reality, the cause is simply volatility and setting stops too close. So while these accusations are occasionally made, it should not be a genuine concern.

Demo

The video below provides a demo of a trade, and shows how to use the platform:

Other Features

Nadex offer their clients the following features and benefits:

- Transparent trading costs – The brand is clear about how they are funded.

- Legal for US residents – CFTC regulated, ensuring trader funds are segregated and traders can be confident in the broker.

- Advanced Charting – The charts and technical analysis tools are among the best in the binary options sector.

- Education – This broker takes trader education to the next level. There are regular free webinars not just on how to use the platform, but how to make consistent profit. The platform is unique, so the education needs to be of a high standard, and it is.

Further Details

What does Nadex stand for?

Nadex stands for: North American Derivatives Exchange

Demo account

This broker offers a no deposit demo account which allows traders to use the same platform as the live account. The demo account is however, limited to 15 days access. Traders could however, discuss an extension with the firm directly.

The demo account is a risk free way to try the trading platform and discover if it suits a trader’s particular style.

Regulation

Nadex are regulated by the US Commodity Futures Trading Commission (CFTC). They are one of only two regulated brokers in the US , where regulation is active and robust.

Trading Hours

Nadex trading hours will be the same as the asset being traded. While the website is available 24 hours a day, assets will only be open when the specific markets are. So European assets will only be available during European trading hours. US assets can be traded during the relevant trading hours in the US, and so on.

How do they make money?

Nadex operate an exchange model. They make a small charge per trade, and these costs are made clear to the trader. Nadex do not take counter party risk on the trades their clients make. For more detail, read our article on how brokers make money.

Robots

At present the firm does not support any form of robot or auto trading facility. An exchange allows traders to set open positions at a price point of their choosing, which means these open order can be left to fill if the price is reached – or not, if that price is no reached.

This allows a certain element of automated trading, but leaves the trader in absolute control.

Signals

There is no specific signal service as part of the platform. Exchange prices themselves are driven entirely by the market, and therefore trader sentiment is ‘built it’.

The charting tools are the best in the market, making advanced technical analysis possible. With a combination of preset patterns to use over the price chart (RSI or Stochastics for example), traders can derive their own ‘signals’ more reliably than elsewhere.

More On Nadex Spreads

More On Nadex Spreads

Nadex is a simple platform to trade many types of binaries. From energy, agriculture, and index futures – to spot FX rates and forex, there is a lot to do on the Nadex platform. What makes binaries attractive to many investors is the low risk. You can risk losing $20 and stand to make $80, and it’s always capped at $100.

Spreads work differently than binaries.

Binaries are based on a yes/no statement: Will the Nasdaq or Wall St 30 (DJIA) be greater than this number at expiration. If you buy the binary at $40 and when the contract expires, the statement is correct on the contract, you gain $60. If not, you lose $40. It’s simple and direct.

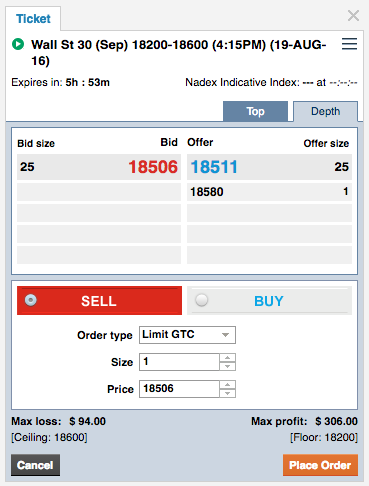

Spreads however, are on a range of high/low, also known as a floor or a ceiling. With the DJIA it could be 18200-18600 with 18200 being the floor and 18600 as the ceiling. The 400 range is known as the spread. If you go short on the trade and sell the contract at 18506 thinking, it will be lower at expiration than what you sold it at. It doesn’t have to break a price barrier or the floor. You make money depending on where it ends up.

Example Nadex Spread Trade

With Nadex spreads, 1 tick equals $1. The trade ‘size’ defaults at 1, so larger trades can be made by increasing that figure – so a size of 2 would mean $2 per tick, and so on.

If you got into the trade at 18506 and by expiration it ended at 18311 you would have made $195. That is the very basics of Nadex spreads.

What trips up a lot of investors about Nadex spreads is treating them like binaries. They assume the spread has to surpass the ceiling, or if they’re shorting the trade… the floor.

The money made or lost depends on 3 things (as illustrated in our screenshot):

- Where they got in on the trade – in the example, 18506

- Whether they’re buying long or short – short, or ‘sell’ in our image

- Where the price ended at expiration – in this case it was 18311

That is the bare bones of a Nadex spread. There is a lot more complicated things involved when you get into trading strategies. But let’s keep things simple.

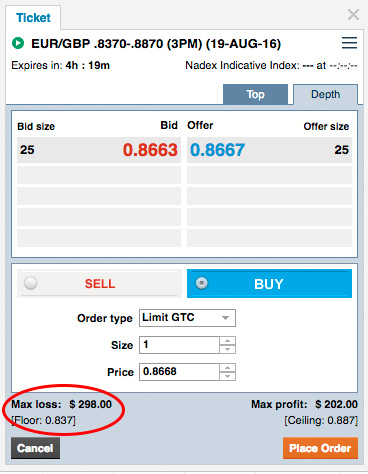

Another scary thought that prevents many Nadex investors from attempting spreads is the Max loss they see. Another example would be if the floor is 17400, and the contract was bought at 17600 so the investor would risk $200. That scares investors, especially if they’re coming from binaries where the risk is much more tolerable.

But that money is on margin and you can control the risk. If you keep an eye on the market and it is dipping below 17600 say to like 17550. You don’t like the direction it is going you can get out of the trade and only lose $50.

Many investors who are used to trading binaries treat spreads like binaries. They are similar in their limited risk that is capped, binaries at $100 and spreads wherever you bought the contract in relation to the floor or ceiling. You can always exit the trade before expiration.

Investors from all walks of life would benefit from spreads. But they need to know how they are constructed first. They know that there is a floor and a ceiling; they know that they can trade many different contracts from indices to commodities and currencies.

But what they need to know first is the three components that make up a spread:

- The underlying asset. That is the market, like a commodity or index.

- The spread range – that’s the floor or ceiling of the spread contract. It is chosen from a variety of spreads depending on the trading scenario. In the Nadex platform you will see different ranges for one market. There could be 5 ranges for Nasdaq or US 100 and only 3 for GBP/USD.

- The third component is the expiration date & time. Nadex spreads have expirations ranging from 1 hour to 1 day whereas Binaries are from 5 minutes to 1 week.

Nadex bull spreads

Something else that confuses investors new to Nadex spreads is in how the floor and ceiling work. It’s simple, where you entered the bull spread contract to where the ceiling is, is the most you can make on that contract. If the market on the contract finishes higher than the ceiling at expiration you only make as much as the ceiling; the same with the floor and bear spread contracts. So to maximize the profit potential, buy a contract at a price closest to the floor. Or sell a contract at a price closest to the ceiling, hoping it will go lower as the expiration time approaches. Your risk is limited and so is your reward. That is the beauty of Nadex spreads. The opposite is another potential strategy – trading a buy close to the ceiling (or sell close to the floor). This effectively risks a large downside for small profit – but has a much higher chance of success. Everything comes down to risk and reward.

For the beginner trader – those who just opened an account and have never once traded binaries or spreads. They should start with spreads. The learning curve is easy, and once they get the hang of it, they will enjoy it much more than binaries alone.

Since spreads are on the Nadex platform investors will be protected, and it’s completely legal in the U.S. What makes spreads attractive to many investors is the profit potential in one trade if they play their cards right. With limited risk and reward spreads are a great vehicle to start investing with; even for the beginner investor. Once you know the basics of how Nadex spreads work, they will be one of your favourite trading instruments.

More On Nadex Spreads

More On Nadex Spreads