Cherry Trade have ceased trading. The firm is no longer accepting new accounts.

Return to the broker comparison table to search for an alternative broker.

CherryTrade are a relatively new broker, but they are building a strong reputation very quickly. Their offices are located in London, but the firm have quickly established themselves across the globe. Running on the SpotOption platform, they have become popular with traders in a short space of time. This backs up their aim to provide a simple introduction to trading, where experience of the stock market is not a prerequisite for success. Their easy to use tools and intuitive design make them an extremely ‘accessible’ broker, and this is further reinforced with their customer support.

There are five levels of account to cater for the differing needs of clients, and they also have a wonderful feature referred to as ‘iFollow‘ which is a fantastic tool for novice traders – that is covered in more detail below.

Head straight to; Payouts

Here are some of the other key details regarding CherryTrade;

- Demo Account – Yes (Real money deposit required in order to open demo account)

- Minimum Deposit – £200

- Minimum trade – £5

- Signals service – Yes

- Bonus details – Deposit match bonus (up to 100%) or risk free trades available.

- Mobile App – Yes. Android and iOS catered for.

Trading Platform

Trading Platform

The trading platform is clear and intuitive, as should be expected where a firm puts such emphasis on making trading accessible for all.

The clear design ensures all the relevant information for a trade is on display, and traders can make choices quickly and easily with all the information they need.

Traders can have more than one trading window open, but each window offers the same display options. On the top left is the asset lists – these are a series of simple drop lists, enabling the trader to select the appropriate asset. Next comes the expiry time, again, this can be amended via the drop down menu. The last row along the top of the trading window in the amount being traded. Completing this field will update the potential payout figure that appears just above the payout percentage. That percentage is clearly displayed so traders know exactly how much any payout will be.

To the left, in the main section of the trading area is the price graph. This displays the recent price movement for the asset selected. This information can be changed by amending the time periods covered. This is of benefit when traders want to see a trend over the slightly longer term. Between the price graph and the payout is the current price – plus the all important trading buttons. Here traders can select their call or put options. The whole trading area is fiendishly simple and new traders will be up and running almost immediately.

Trader choice

CherryTrade offer a great range of binary option types.

- Binary Options – The traditional High/Low options. Will the asset rise in value, or fall?

- Pairs – Which of two assets – generally corporate stocks – will perform best? The pairs of assets will normally be related, for example Google versus Amazon. This type of trade is not available with most brokers.

- Long term – Long term options follow the same principals as standard binary options – but the expiry periods are longer. Expiry times can be from a week or two, up to 9 or 12 months.

- 60 Seconds – High octane trading! Again, the actual trade is similar to that of a standard binary option, but here, the expiry times are exceptionally short – 60 seconds or less.

- One-touch – A popular and potentially quick-fire option type. Will an asset ‘touch’ a particular value prior to the expiry. One touch options generally have a high touch value, and a low touch value.

- Ladders – Not available at many brokers, CherryTrade also offer ladders via their platform. Ladders are staggered price levels that allow traders to make substantial returns if an asset value breaks through a number of ladder ‘rungs’. Payouts at CherryTrade can reach over 1000% with these types of instrument.

- iFollow – The iFollow feature is listed alongside trade types, but is not really a trade type. It is a tool for allowing traders to mimic the trades made by other profitable traders. This is covered in more detail in the ‘Other Features’ section.

The assets lists at CherryTrade are good, though some brokers may offer more currency pairs and commodities. That said, all the well traded assets are there and as a relatively new broker, CherryTrade will add to their offering as they go.

Mobile App

CherryTrade make their trading platform available on mobile for both iOS and Android (version 2.3.3 and above). The mobile app presents a trading area which is equally easy to use as the full website. The trading buttons are well positioned and sized, so while all the information is available, the screen does not become to ‘fiddly’ to use.

CherryTrade make their trading platform available on mobile for both iOS and Android (version 2.3.3 and above). The mobile app presents a trading area which is equally easy to use as the full website. The trading buttons are well positioned and sized, so while all the information is available, the screen does not become to ‘fiddly’ to use.

Historical trading information is presented on the mobile application too, with open positions listed and then a similar page listing expired positions. All the relevant details of those trades is displayed. Account details are also accessible from the mobile app including deposit and withdrawal requests. An account balance can be displayed at anytime, in any screen, enabling traders to stay up to date where ever they are.

The app is a great addition for CherryTrade and has been well received by traders looking for a mobile solution.

Payout

CherryTrade generally offer payouts around 81%, and this will depend on the asset class and expiry time. Payouts are at the higher end of the spectrum relative to rivals, and the more exotic trade types can provide even higher payouts. Ladders in particular can offer huge payouts (as much as 1000%) if traders believe an asset is approaching a volatile period, and price movements will be significant.

Withdrawal and deposit options

CherryTrade offer a wide range of deposit and withdrawal options. They also employ some stringent security arrangements, these include ‘proof of identity’ processes that need to be met before funds can be deposited (Photo ID, proof of address and if using a credit card, a copy of that). This also however, smooths the withdrawal process.

Deposits can be made via eWallet, CashU, Wire Transfer, Maestro or Credit Card (Credit cards accepted include Visa, Delta, MasterCard, Diners, and Visa Electron). Wire transfer deposits may attract a fee unless they are above $500.

Withdrawals require the same proof of identity steps before being actioned. This can be a bone of contention with some traders who view it as an unnecessary delay – but it is a legal money laundering requirement, and actually protects the consumer.

There are no fees for withdrawals back to a credit card – and traders can make one wire transfer per month free of charge – there is however a $30 fee for extra withdrawals made via wire transfer each month. Withdrawals can only be made back to the same card that made the deposit. Also, withdrawals cannot exceed the total deposits made with that card – the remainder will need to be transferred via wire transfer. This effectively means any profit from trading will need to be withdrawn direct to a bank. There is also a maximum withdrawal figure of $20,000 per withdrawal.

Withdrawals can be cancelled by the trader if the funds are required in the account. As long as the withdrawal has not been processed, cancellations can be made directly with CherryTrade, either by email or telephone.

Other Features

CherryTrade have one additional feature in particular that makes it an attractive proposition – the ‘iFollow’ option. Here are some details about that, and other features;

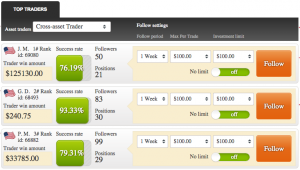

- iFollow – This feature allows traders (particularly novices) to follow the trades made by the most successful traders on CherryTrade. Users can select the traders they want to follow, choose how long they follow them for, and how much to place on each trade. CherryTrade will then open the same trades automatically, allowing traders with little experience to profit from knowledgable and profitable traders. There is a growing trend for this sort of feature, but CherryTrade are ahead of the game here.

- Rollover – Postpone the expiry time of a binary option, to the nearest available expiry time, in exchange for a premium.

- Double Up – Traders can repeat their current trade in a single click, allowing them to maximise profits from a sustained price move, or trend that looks set to continue.

CherryTrade offer a great option for novice traders, hence the rapid growth they have enjoyed. They also, however, cater for more experienced traders by delivering a good asset list and large variety of trade types.