According to industry sources, oil organisation OPEC could soon be set to cut production in an attempt to halt another dramatic drop in crude prices. The move, confirmed in part last week, is first of its type since the financial crisis. This week also saw announcements of cuts from the non-OPEC oil producers too.

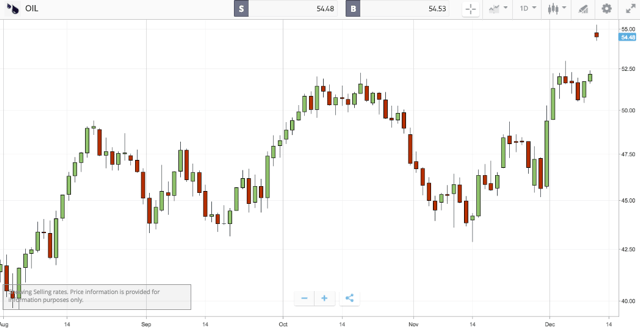

Oil Price (Daily Chart)

OPEC production cuts

The problem of over-supply has long plagued the sector and though the powerful alliance of oil-producing countries is determined to achieve higher prices, it is also fearful that production cuts will open the door to non-members.

Despite these concerns, a number of experts have stated that there is little room left for manoeuvre and that a failure to sign-off on production cuts will catalyse a further ill-advised fall in prices.

The first meeting to discuss such a move took place last week, when a 14-member producer group convened in Vienna to negotiate a supply deal. This follows on the heels on an unprecedented two-year downturn, which has damaged budgets and decimated the global oil industry.

Irrespective of these dire straits, optimism is limited, and Societe Generale’s Michael Wittner has openly stated that: “The likelihood of a credible [output] cut is a 50/50 toss-up.”

The group would need to come to an agreement which cut over one million barrels a day in order to hit the targeted 32.5 million barrels per day set in September’s provisional accord.

A failure to do so could lead to a serious backlash, with expert Torbjörn Törnqvist explaining that: “We think OPEC will reach an agreement. However, if they walk away without a deal, the market will punish that result, possibly by $10 a barrel or more.”

Oil Price Needs Support

The cartel, which is responsible for one-third of worldwide crude oil production, remains at odds over how such a cut would be divided, with Iran and Iraq proving vocal in their dissent.

Yet some form of agreement still seems inevitable, with a meeting two months prior yielding an annual high of $53 a barrel, which fell by an astonishing 20% after odds on the outcome of the deal were cut in mid-November.

With only one clear way to guard the price of oil from dropping again, it seems that OPEC must reach a decision, or else irreversibly endanger the future of their livelihood.

How will this news impact your trading?

Trade Oil prices over a range of expiry times at 24Option: