Daweda have ceased trading. The firm is no longer accepting new accounts.

Return to the broker comparison table to search for an alternative broker.

Daweda offer binary options trading via a trader to trader exchange. They are based in Cyprus and regulated by CySec. While other brokers are able to offer exchange traded binary options, Daweda are the only firm dedicated to purely binaries. The assets available to trade all boast strong liquidity. Expect that to continue as the platform becomes more widely used, and more markets are added.

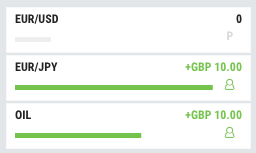

A peer to peer exchange means Daweda are not the counter party to any trade. They simply match two traders who take opposite views on the same asset. The firm make a small charge for each contract opened and therefore can afford to offer payouts of 100%, without a spread.

Key info for the Daweda binary exchange;

- Demo Account – Yes (Demo balance is available immediately on sign up)

- Minimum Deposit – £100

- Minimum trade – £7 ($10 currency equivalent)

- Signals service – No.

- Bonus details – Monthly cashback for loyal, active traders.

- Mobile App – Yes. Compatible across all platforms.

Trading Platform

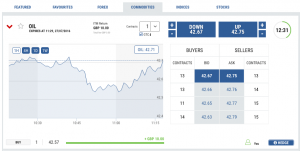

The Daweda platform is very simple. The asset menu runs along the top of the trading area, and the available assets and expiry times are listed underneath. Selecting the required market then updates the price graph. The graph can be toggled between timeframes, and illustrates the current price. Hovering over the ‘Buy’ and ‘Sell’ buttons will also trigger a grey area to appear on the price graph – this illustrates the level at which an option can be brought or sold.

Each contract incurs a $0.50 fee, and the minimum contract is $10 (or currency equivalent). Accounts can be opened in GBP. Multiple contracts can be selected using a drop down in the centre-top of the trading area. Once traders are comfortable with the trade size, they can use the Buy/Sell buttons.

Clicking directly on the buttons will trigger a new option ‘order’ at that level. Using the +/- buttons however, amends the price level – so traders can open an option order at the price level they require. A pop-up will then appear, asking the trader to confirm the order. The order is then live, and needs to be matched by another trader. This is genuine peer-to-peer trading. So orders will not always be matched – but traders can set exactly the price level they want in order to enter a trade. This is one of the key points of an exchange. For an option to be placed, another trader needs to be willing to take the opposite view on an asset.

Open orders, and orders waiting to be matched, appear below the price graph, and on the top right of the trading area, with the current status also displayed.

Open orders, and orders waiting to be matched, appear below the price graph, and on the top right of the trading area, with the current status also displayed.

Trader Choice

Trading variety will certainly grow at Daweda. As a peer to peer exchange, there needs to be a vibrant, liquid market in order for traders to get matched on both sides of a trade. As a fairly new (but growing) brand, Daweda have focussed on the popular markets to ensure there is liquidity. Traders can judge the liquidity for themselves by looking at the open lists.

Popular Forex pairs and commodities are available, as are certain stocks and US indices.

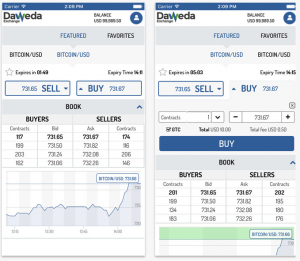

Daweda Mobile App

Daweda offer their exchange on both Android and iOS mobile platforms (both iPhone and iPad). The mobile application gives traders access to the full range of exchange assets, plus it lists working orders on contracts. The screens are clear and easy to use, making the simplicity of the exchange available for traders on the move.

Daweda offer their exchange on both Android and iOS mobile platforms (both iPhone and iPad). The mobile application gives traders access to the full range of exchange assets, plus it lists working orders on contracts. The screens are clear and easy to use, making the simplicity of the exchange available for traders on the move.

A ‘Favourites’ list of assets can be added too (just as on the full website) to make accessing markets quicker on a mobile device. Account maintenance options are also available. The mobile offering is a great addition to the main site.

Auto Trading Software

Daweda offer an ATS service – Automatic Trading Software. Similar software is sometimes referred to as a trading ‘robot’, or auto-trader. The Daweda setup allows traders to configure their own trading system, and run it automatically, with no need for any further interaction. This a great innovation from the firm, illustrating their desire to match the ‘over the counter’ brokers with their peer to peer exchange.

The ATS can be setup in a series of steps:

- Choose the number of contracts you want per trade (this sets the maximum risk per trade)

- Set a limit for the number of trades per day (Manage the risk per day)

- Configure your trading strategy

- Decide if you want a profit limit per day (The ATS stops once this is reached)

- Decide if you a loss limit per day (The ATS stops once this is reached)

- Select the assets to trade

- Activate the ATS, and set it ‘live’

As Daweda is an exchange, the ATS provides a great tool for ensuring trades are triggered for the exact price point you need. This speed is beyond what can be achieved trading manually.

Payout

Payouts at Daweda are listed as 100%. Traders need to be aware however, that there is a $0.50 charge per contract (if hedging, this is charged on both contracts) so a 50% in-the-money rate will still make a small loss over time.

There is however, no spread to “make up” as the price matched, is the price the contract is struck at. Both buyer and seller “match” at the same price.

Withdrawal and Deposit Options

Withdrawal and Deposit Options

Daweda accept deposits via Credit card, Skrill (Money Bookers), WebMoney and bank wire transfer. The deposit process is fairly simple, but as with most regulated brokers, there will be some verification required.

Withdrawals are a simple process too, with no minimum amount. One withdrawal a month is free – any additional payouts in the same calendar month will incur a $25 charge (or equivalent). Traders will however, need to withdraw to the same method with which they made their last deposit.

Daweda process withdrawals within 24 hours, which puts them among the fastest for organising trader withdrawals.

Other Features

Daweda offer their clients the following features and benefits:

- Cashback – The longer trader stay at Daweda, and the more they trade, the higher their cashback will be. Traders are automatically enrolled, and the funds are paid automatically into account too. Win-win.

- Education – As the platform is unique, there is extensive material on how to use it, including the ‘hedge’ feature.

- Order book – Central to the Daweda Exchange is the Order Book – a unique feature that allows traders to view all the current orders on any chosen asset. Dynamic, and updated in real time, it gives a clear idea of market activity at a single glance. It illustrates the supply and demand of an asset clearly and concisely, and is always available.

- Hedging – Hedging creates an entry in the Order Book that offsets any position with a counter-trade. Once a contract is matched, the open orders screen will highlight the opportunity to Hedge. When matched by another client, the hedge will balance the original position and protect the trade.

- Professional Client Program -The Daweda Exchange Professional Client Program allows professional clients to trade using automated tools developed by themselves, or alternatively with the help of bespoke solutions using the wide range of products and services at Daweda that will suit the traders needs.

Withdrawal and Deposit Options

Withdrawal and Deposit Options